Advantages Of Gst In Malaysia

Sst is double taxation contrary gst is a tax system on goods and services.

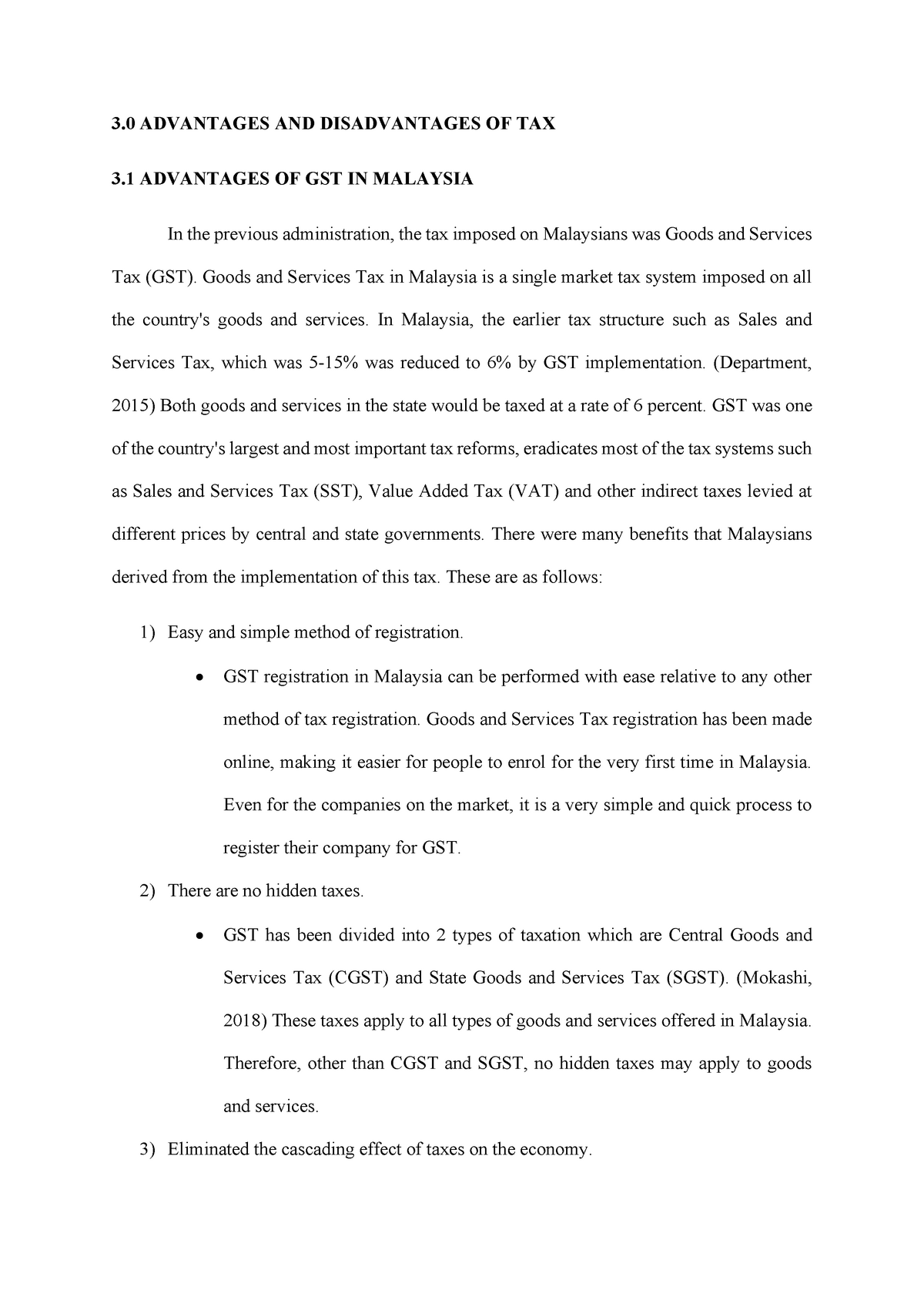

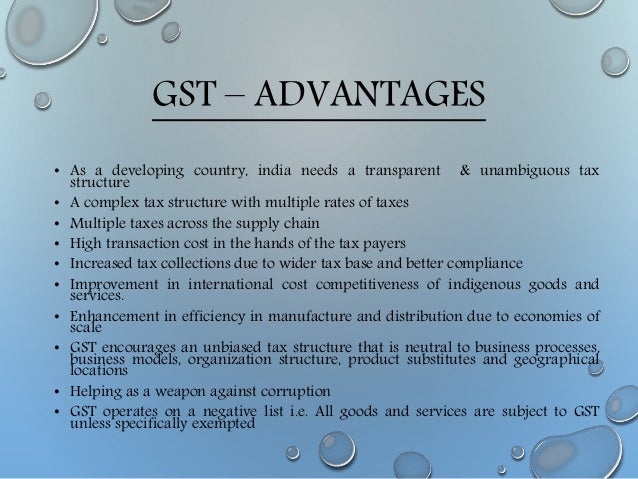

Advantages of gst in malaysia. Tax burden will not increase when income level increased. Everyone will pay tax and tax burden is spread over instead of just relying on income taxes derived from 15 of the working population. Gst has advantages to certain degree because the revenue increased is not just from local people but from the foreigners too. Advantages fairer pricing under gst the consumers will pay the same amount of tax which is 6 to certain particular goods and services.

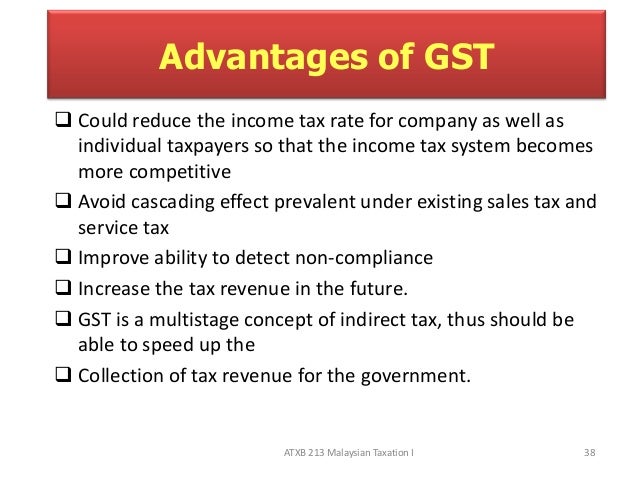

The collection of the gst can increase the revenue from the tourism industry as some revenue is extracting directly from tourists where the tourists spend on goods and services that made in malaysia and overall government revenue will be increased. This means consumer will pay. Gst will eliminate the double taxation under sst. 5 28 2018 advantages and disadvantages of gst in malaysia business setup worldwide 1 7 the goods and services tax gst was pm rst planned to be introduced in the 3 quarter of 2011 by the government of malaysia.

The primary objective behind the new and improved gst tax system in. Advantages fairer pricing under gst the consumers will pay the same amount of tax which is 6 to certain particular goods and services. But the launch was postponed due to avid criticism and the tax pm nally came into effect on 1 april 2015. Gst in malaysia has been favorable towards the business people in the country.

This means consumer will pay. So if you are planning on setting up a company in malaysia it s a fairly lucrative time. Gst will eliminate the double taxation under sst. As the cost of goods reduces consumption rate increases which benefits companies.

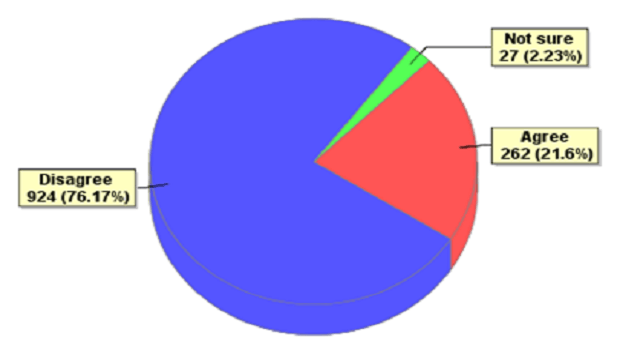

Gst can help the diversification of income sources for the government instead of just relying on income tax and petroleum tax alone. What are the advantage and disadvantage that we can see are. Among the other advantages of gst is the gst rate is lower six per cent compared to sales and service tax sst at 10 per cent and six per cent. What your opinion when gst were implementing in malaysia.