Assessment And Quit Rent Malaysia

It must be paid by the landlord to the state authority via the land office and is payable in full amount from 1 st january each year and will be in arrears from 1 st june each year.

Assessment and quit rent malaysia. It is a form of land tax collected by state governments and is imposed on owners of freehold or leased land. Quit rent cukai tanah is a tax imposed on private properties. Cukai tanah also known as quit rent or land tax is the tax you pay on owning whatever it is that you own on a piece of land even if it s just the land itself. 3 6 rent or rental income or income from letting includes any amount received for the use or occupation of any real property or part thereof including premiums and other receipt in connection with the use or occupation of the real property.

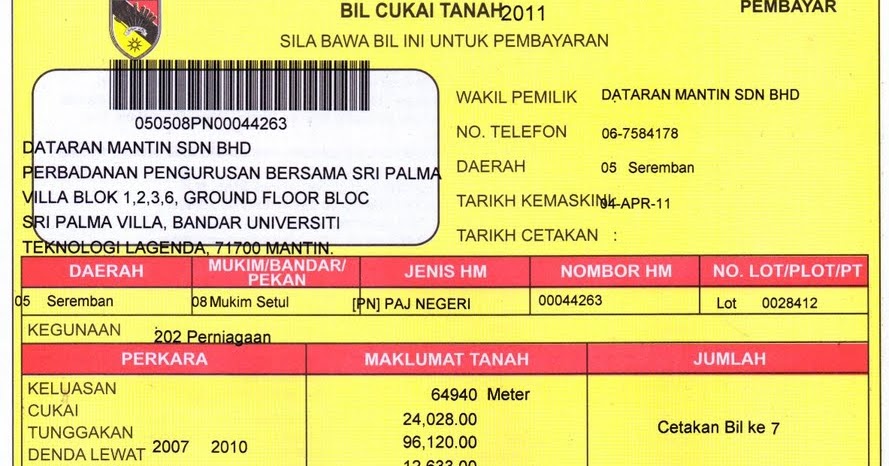

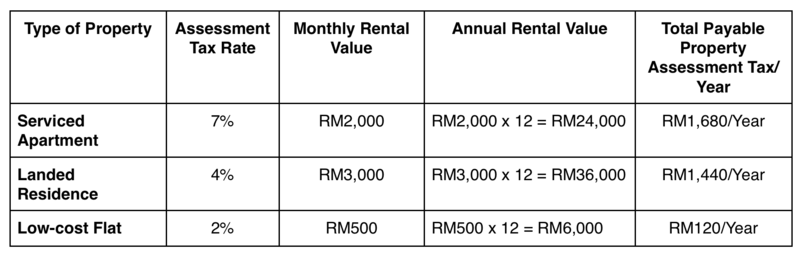

In 1760 the colonial government passed a 10 year quit rent exemption on properties in the lake champlain area to encourage settlements in upstate new york and vermont. Referred to as cukai tanah in malay quit rent is the payment that owners of local properties make to the malaysian government through the land office or pejabat tanah dan galian ptg. Assessment tax on residential property. Quit rent is an annual land tax imposed on private properties in malaysia while parcel rent is its equivalent for stratified properties both are payable to the state authority.

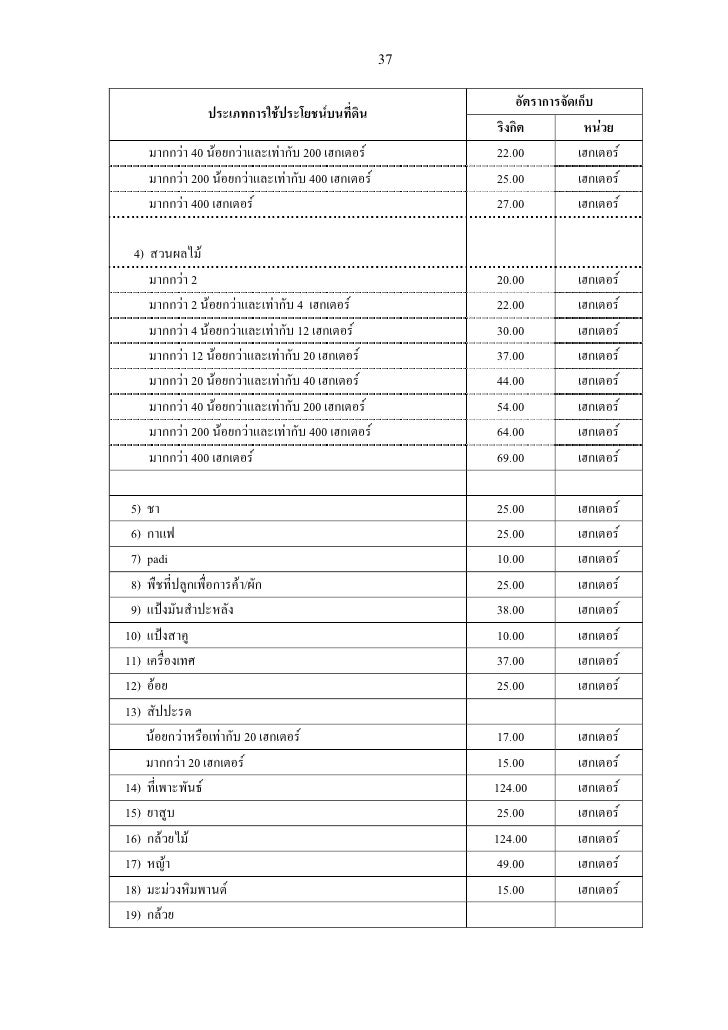

3 7 related company means the situation where one company holds not less. Nowadays the national land code makes it compulsory for all landowners to pay cukai tanah now also known as quit rent once a year to the relevant land office of their state government. Assessment rates or cukai pintu is a local land tax collected by local councils to pay for developing and maintaining local infrastructure and services. Cukai tanah is calculated at a varying rate depending on the type and size of the property that is built on the land.

The united states had such a system before the revolutionary war. Meanwhile assessment tax cukai taksiran is collected by local authorities to finance the construction maintenance of public infrastructure. Assessment tax is unique to malaysia. It may seem like a rather unusual term at first but quit rent is actually one of the most common and fundamental systems in malaysia s property scene.

This system only persists in malaysia in the 21st century. Since malaysia still has all its kings and the land tax is a healthy source of income for the states we citizens still have to pay it. Quit rent cukai tanah besides the assessment tax the other main cost associated with property and land ownership in malaysia is quit rent or cukai tanah. The bill is yellow in colour.

It is generally levied at a flat rate of 6 for residential properties and payable in two installments.