Capital Expenditure And Revenue Expenditure Difference In Hindi

This refers to the estimated expenditure provided in the budget for spending during the year on routine functioning of the government.

Capital expenditure and revenue expenditure difference in hindi. As a businessperson it is essential to understand both capital and revenue expenditure. Revenue receipts are shown in the credit side of trading account or profit and loss account. This video give the basic concept basic logic s difference between capital expenditures revenue expenditures. Summary of capital expenditure and revenue expenditure.

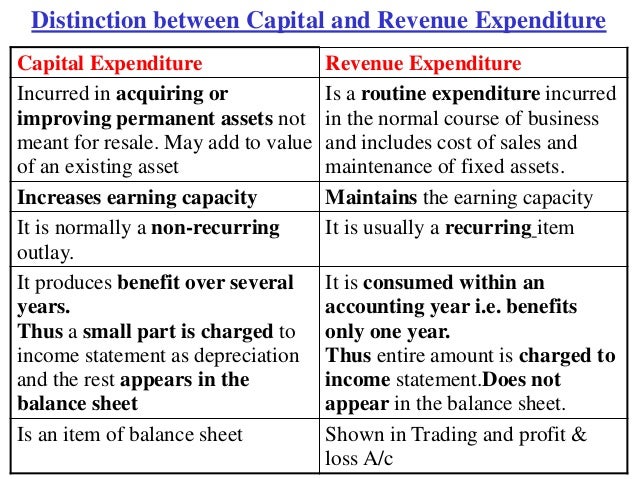

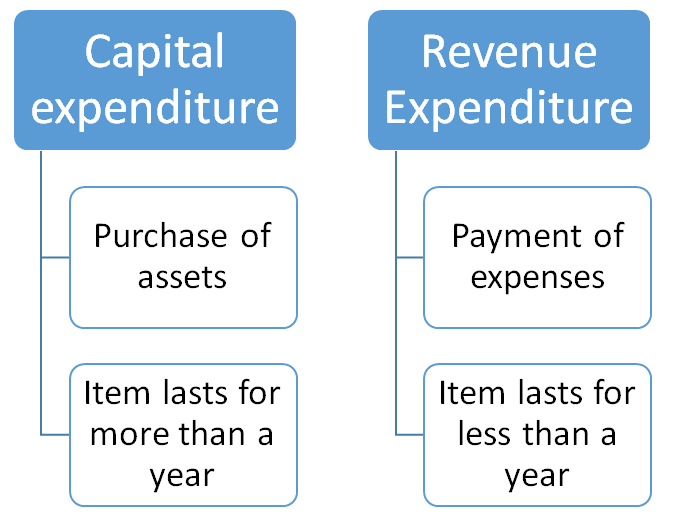

The cost of acquisition not only includes the cost of purchases but also any additional costs incurred in bringing the fixed asset into its present location and condition e g. This post first appeared on coaching tally accounts finance taxation bankin please read the originial post. Capital expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increases the earning capacity of an existing fixed asset. Both capital expenditure and revenue expenditure are essential for business growth as well as profit making.

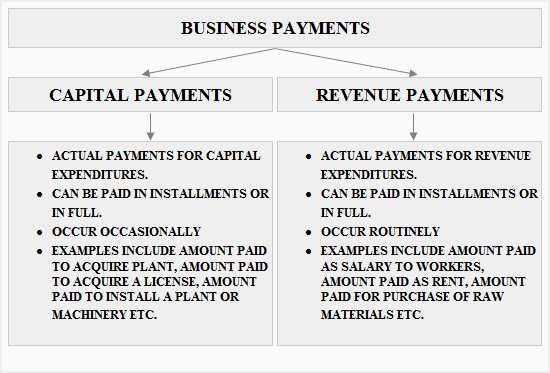

Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence. Urdu hindi my recommenmd amazing gears products. The wages paid for installation or constructing any fixed assets is capital expenditure. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term.

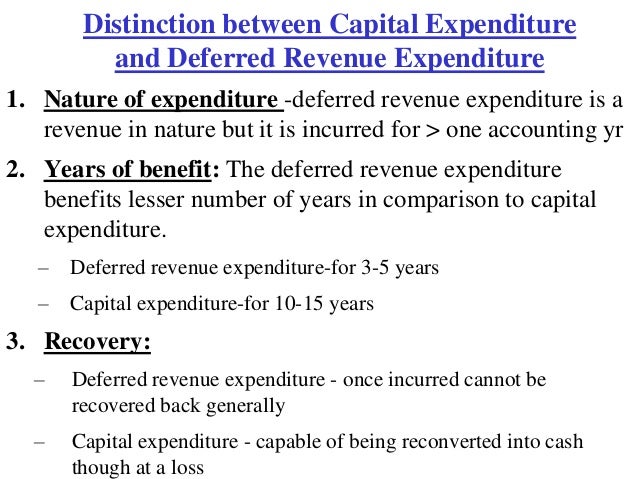

The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term. Capital expenditures capex are funds used by a. Therefore it is added in the assets. Such expenses which appear to be revenue but are capital in nature.

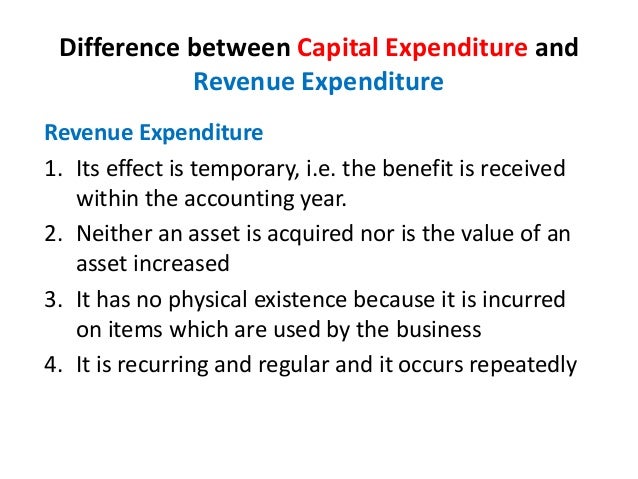

An expenditure that neither creates assets nor reduces a liability is categorised as revenue expenditure. Revenue expenditure and capital expenditure of india. The difference between capital expenditure and revenue expenditure are expained in tabular form. Plan expenditure is further sub classified into revenue expenditure and capital expenditure which along with their components are shown in the preceding chart.

Both help the business earn profits in present in and in following years. The post difference between capital expenditure and revenue expenditure in hindi appeared first on best tally accounts finance taxation sap fi coaching institute in dehradun.