Capital Expenditure And Revenue Expenditure Difference

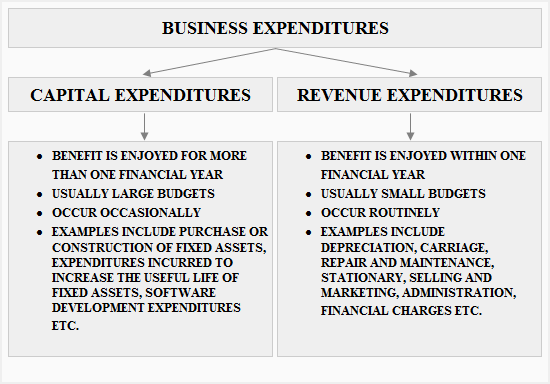

B revenue expenditure is money spent on the daily running expenses of the business.

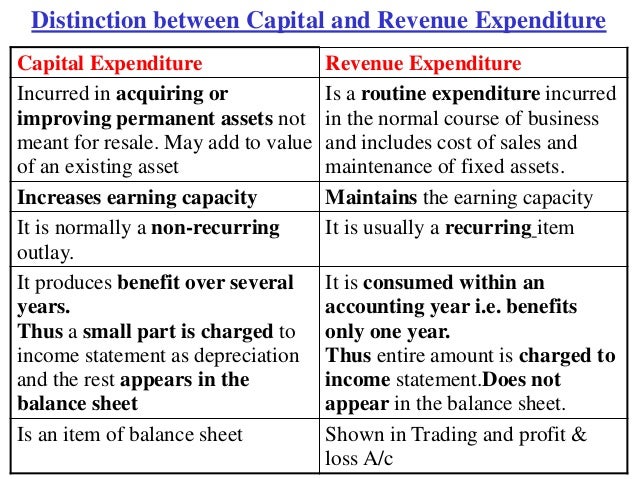

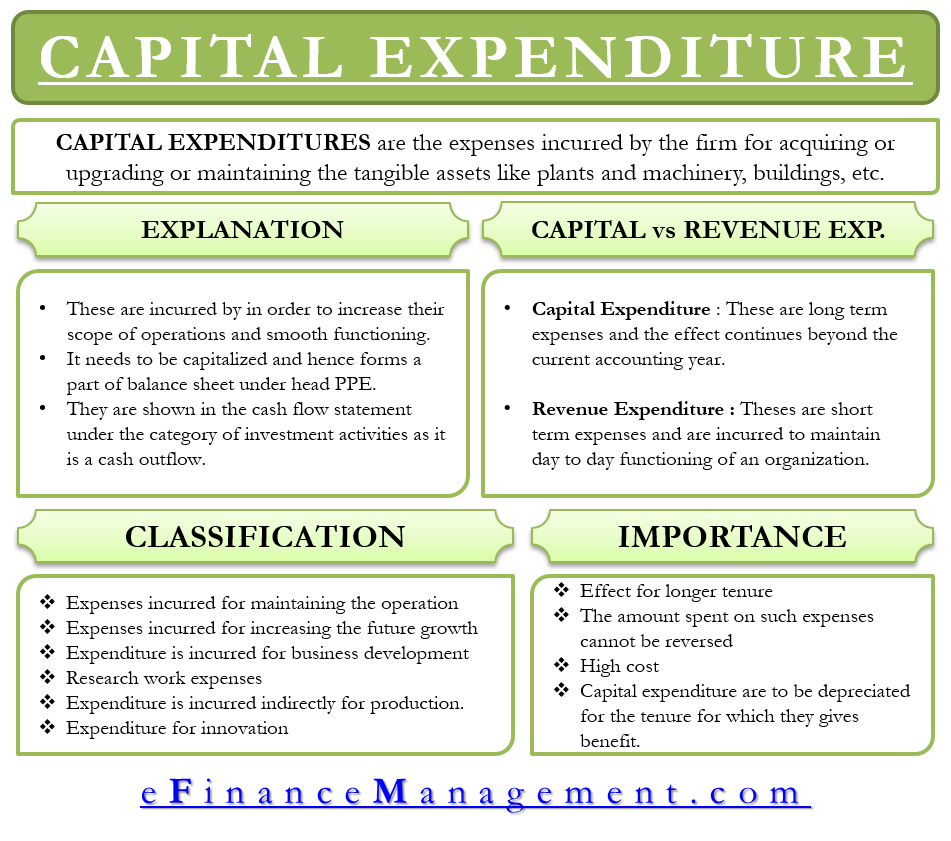

Capital expenditure and revenue expenditure difference. What is a capital expenditure versus a revenue expenditure. Its benefits received within the existing accounting year. Usually the cost is recorded in a balance sheet account that is reported under the heading of property plant and equipment. Capital versus revenue expenditure.

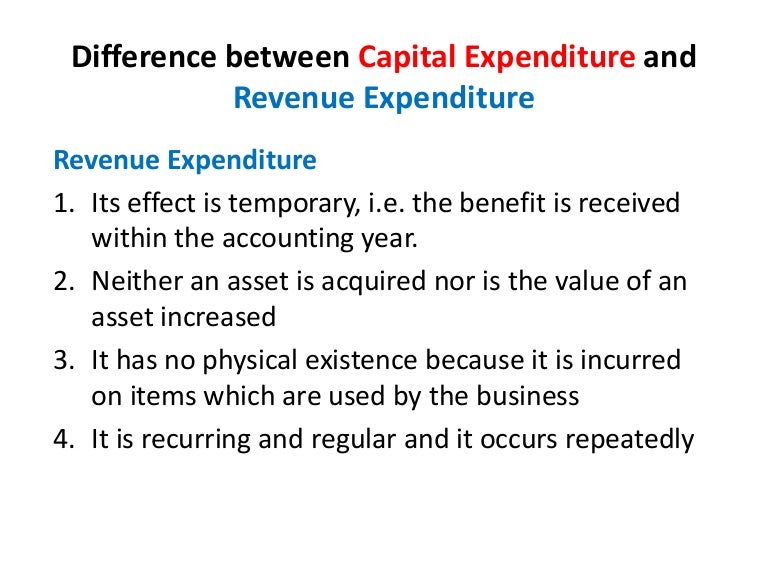

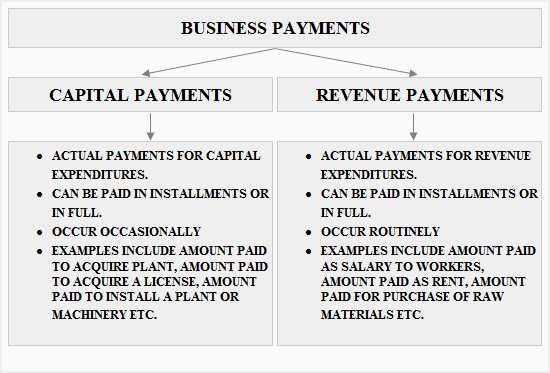

Capital expenditures are for fixed assets which are expected to be productive assets for a long period of time. The difference between capital expenditure and revenue expenditure are expained in tabular form. The difference between revenue expenditures and capital expenditures is another example of two similar terms that are easily mixed up. Revenue expenditures are for costs that are related to specific revenue transactions or operating periods such as the cost of goods sold or repairs and maintenance expense thus the differences between these two types of expenditures are as follows.

Its effect is long term i e. Its effect is temporary i e. Capital expenditure is a long term expenditure and accordingly has a long run effect on the business. A capital expenditure is an amount spent to acquire or significantly improve the capacity or capabilities of a long term asset such as equipment or buildings.

It is not exhausted within the current accounting year its benefit is received for a number of years in future. Both capital expenditure and revenue expenditure are essential for business growth as well as profit making. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term. Examples of differences between capital and revenue expenditure.

Capital expenditures capex are funds used by a. A capital expenditure is money spent to buy fixed assets. It not depleted within an existing accounting year. Purchase a building rent a building.

Capital expenditure revenue expenditure. Summary of capital expenditure and revenue expenditure. Both help the business earn profits in present in and in following years. Understanding how each should be tracked can mean big savings over time and should be a firm part of your accounting strategy.

The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term. Definition of capital expenditure. The benefit is received within the accounting year.