Capital Expenditure And Revenue Expenditure Examples

But the range is wider than that.

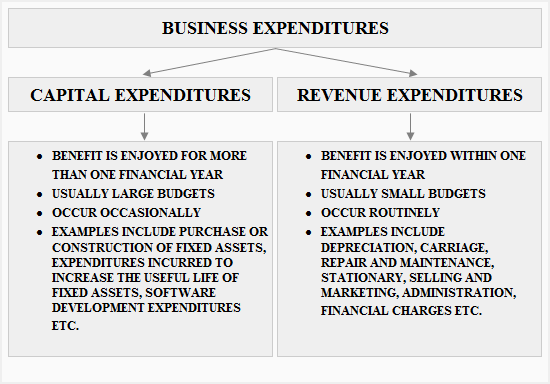

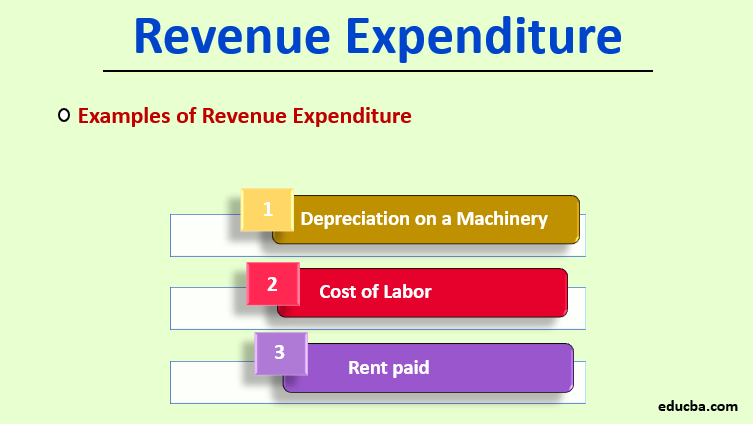

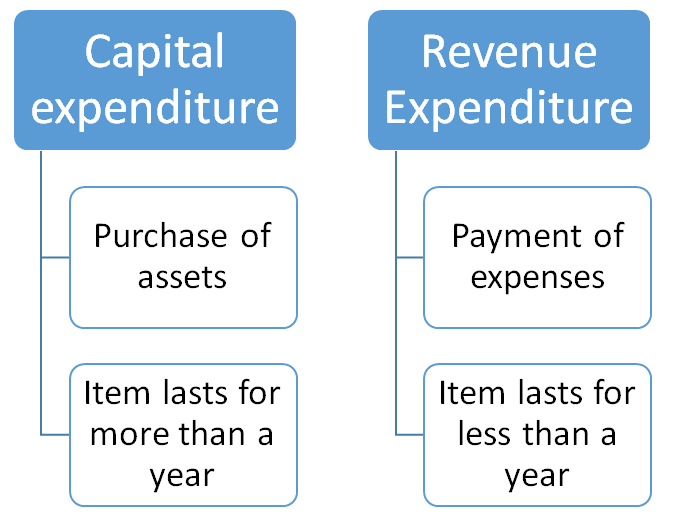

Capital expenditure and revenue expenditure examples. Revenue expenditure refers to those expenditures which are incurred during normal business operation by the company benefit of which will be received in the same period and the example of which includes rent expenses utility expenses salary expenses insurance expenses commission expenses manufacturing expenses legal expenses postage and printing expenses etc. Raw materials salaries rent taxes postage etc. Revenue expenditure is made during the. Examples of differences between capital and revenue expenditure.

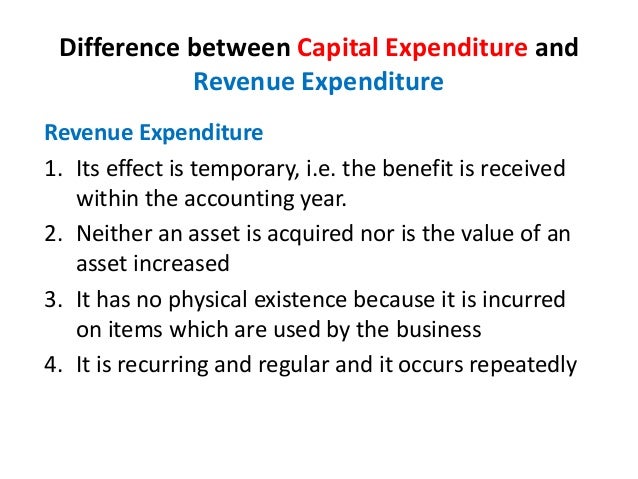

Revenue expenditures is the item of expenditures which benefits may expire within an accounting period. Rent on a property. Routine repair update costs on equipment. These expenditure will not increase the efficiency of the business.

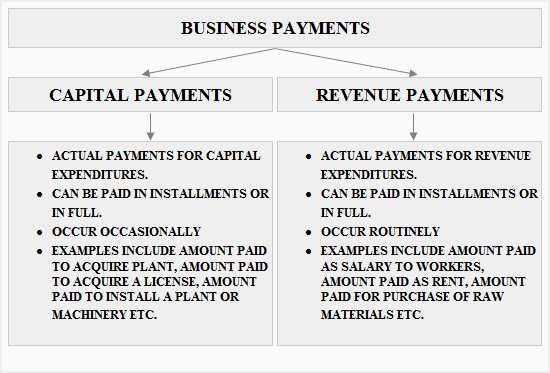

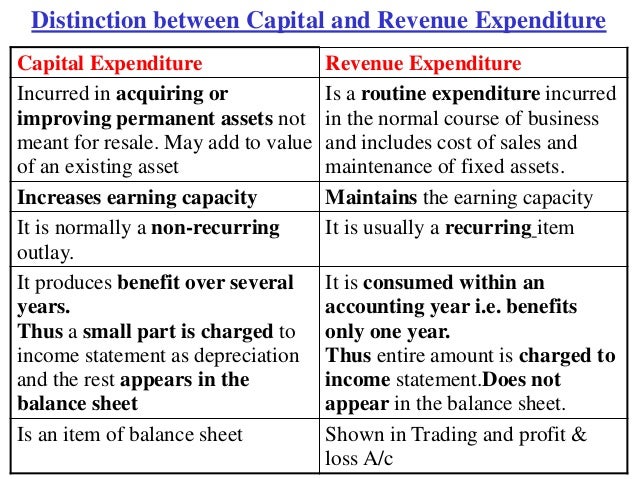

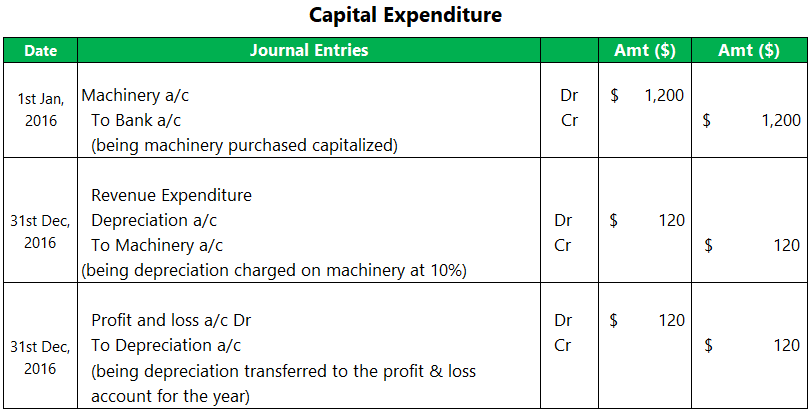

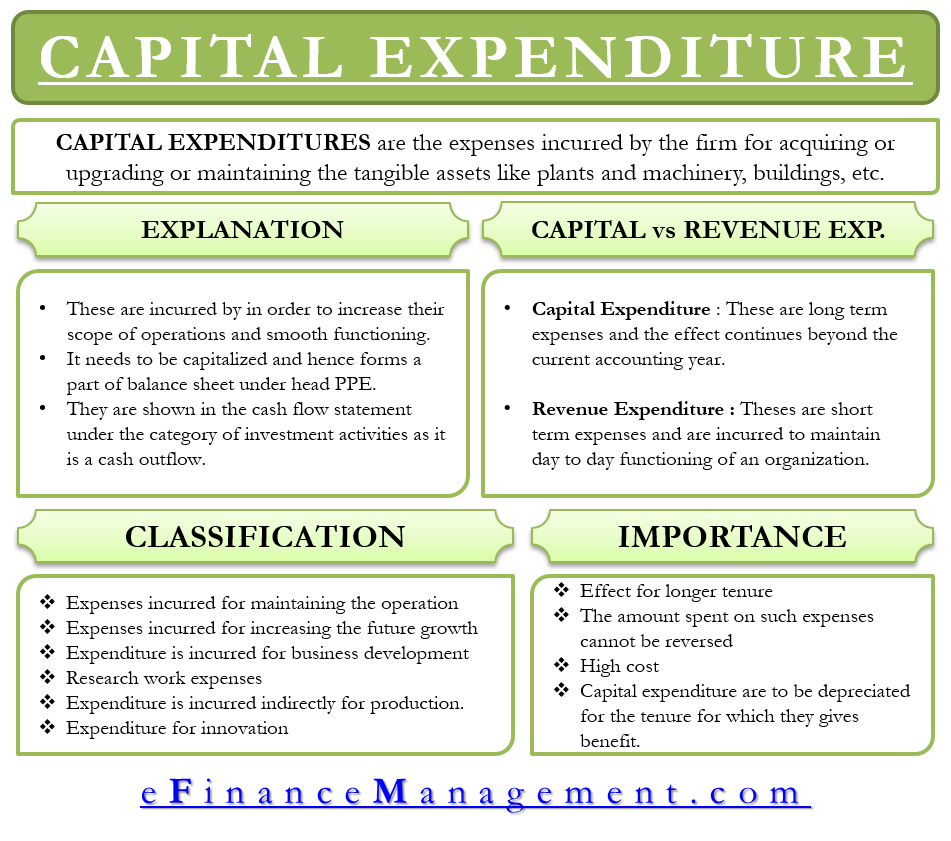

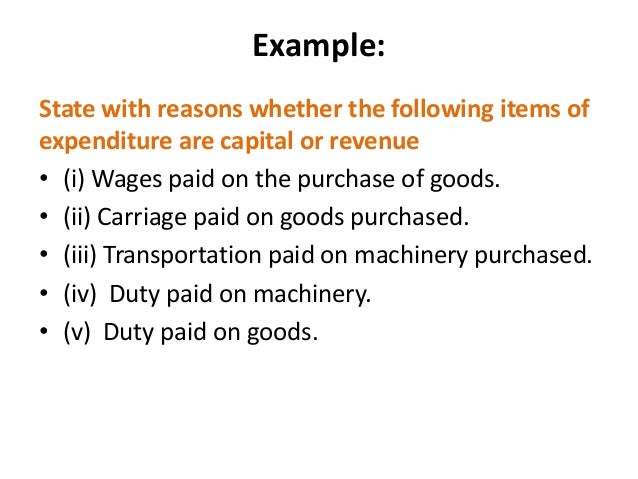

Capital expenditure revenue expenditure. From the example you should. The distinction between the nature of capital and revenue expenditure is important as only capital expenditure is included in the cost of fixed asset. How to account for capital expenditure and revenue expenditure.

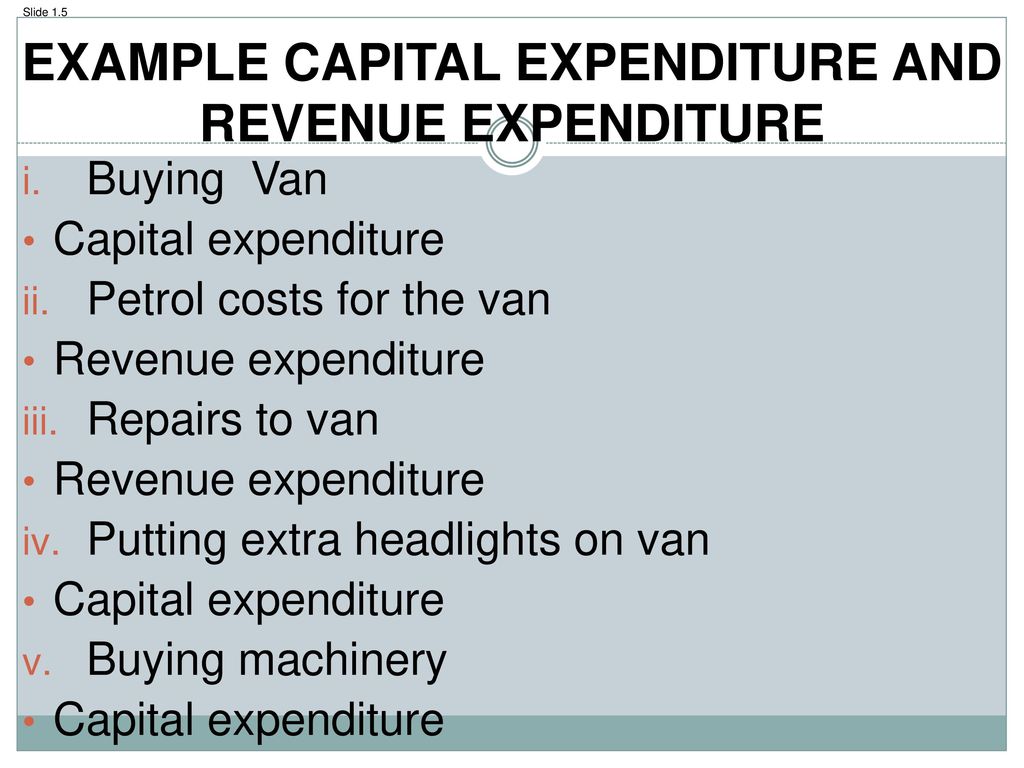

The expenses a firm incurs each day to maintain its daily business activities are revenue expenditure. So far we ve spoken mainly about physical revenue expenditures. Purchase a building rent a building buy a new vehicle repair a vehicle addition to a new building redecorating existing building installation cost of new equipment electricity costs of using the equipment. Let s look it another way if a company is involved in property dealing business the purchase of the buildings will be a revenue expenditure while the purchase of machinery would be a capital expenditure.

Cost of goods sold. Day to day expenses required to run a business. The acquisition of the building will be a capital expenditure while the purchase of computers will be a revenue expenditure. Smaller scale software initiative or subscription.

Capital expenditure capital expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increases the earning capacity of an existing fixed asset. Repairs and maintenance of other assets. Tsla is an automobile manufacturer of electric vehicles. Below is a truncated portion of the company s income statement and cash flow.

Examples of revenue and capital expenditures. Types of revenue expenditures. Example of capital and revenue expenditures. All of the following are examples of revenue expenditures.

Examples of revenue expenditures.