Capital Expenditure And Revenue Expenditure

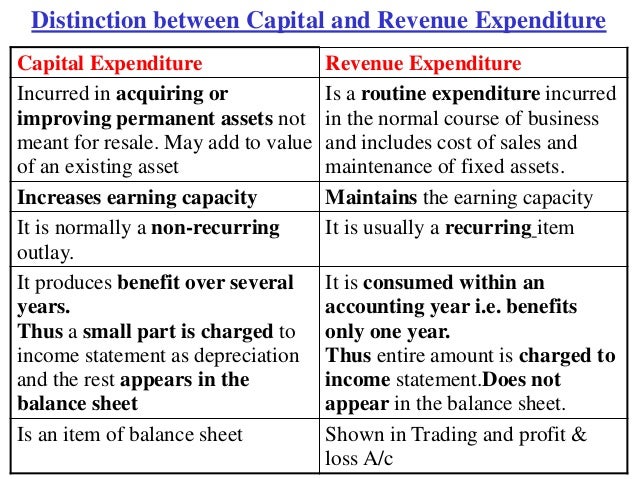

A capital expenditure is assumed to be consumed over the useful life of the related fixed asset.

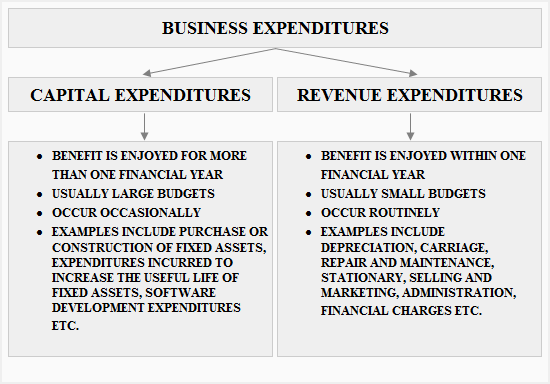

Capital expenditure and revenue expenditure. Definition of capital expenditure. Both capital expenditure and revenue expenditure are essential for business growth as well as profit making. Revenue expenditure is a periodic investment of money that does not benefit the business nor leads to any loss in any way. Plus capital expenditures will show up differently on your reporting metrics.

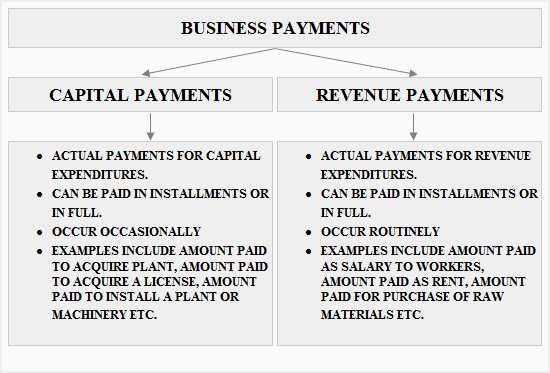

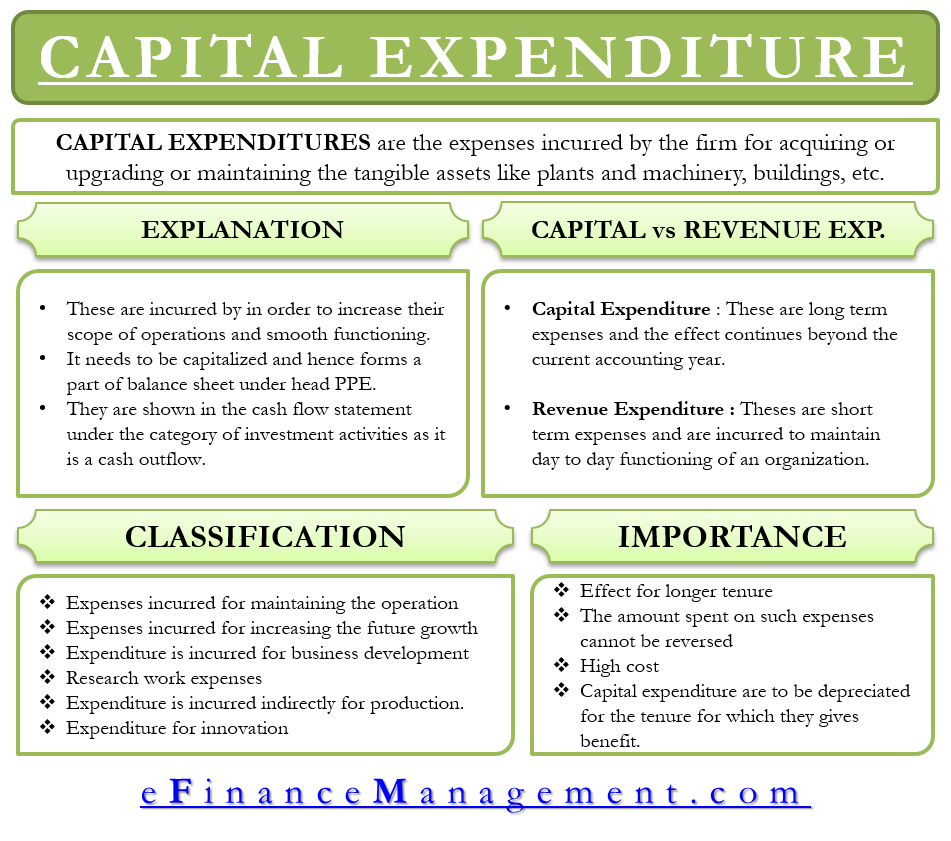

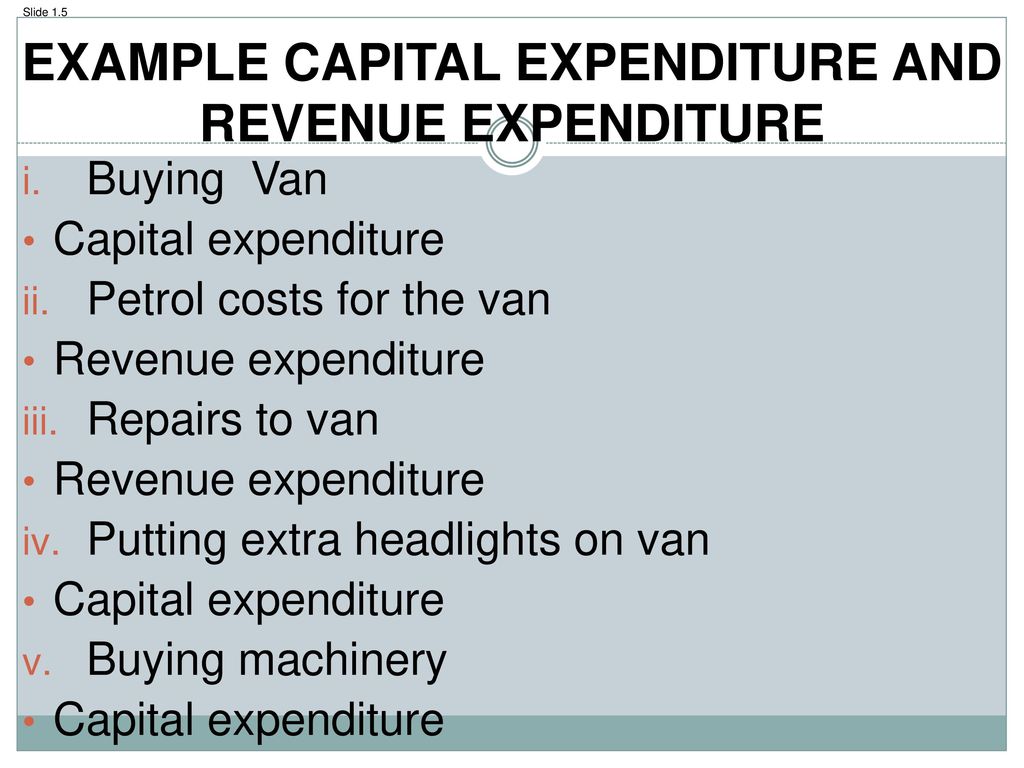

A capital expenditure is an amount spent to acquire or significantly improve the capacity or capabilities of a long term asset such as equipment or buildings. What is a capital expenditure versus a revenue expenditure. It s not enough to say that capital expenditures are everything that revenue expenditures aren t. It is an amount spent to buy a non current asset.

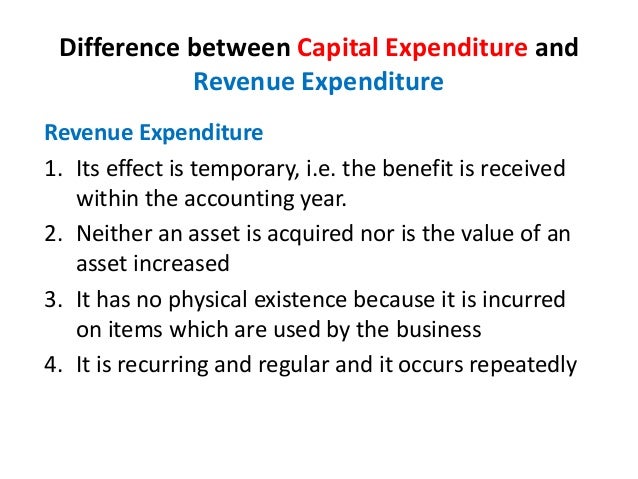

Revenue expenses are short term expenses to meet the ongoing operational costs of running a business. It is an amount spent to meet the day to day running costs of the business. Both have its own merits and demerits. In the case of a capital expenditure an asset has been purchased by the company which generates revenue for upcoming years.

Capital expenditure includes costs incurred on the acquisition of a fixed asset and any subsequent expenditure that increases the earning capacity of an existing fixed asset. Both help the business earn profits in present in and in following years. Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible. With a capital expenditure a company purchases an asset which helps generates profits for the future.

While on the other hand capital expenditure is the long term investment that only benefits the business. S no capital expenditure revenue expenditure. Capital expenditures are major investments of capital to expand a company s business. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years.

Capital expenditure and revenue expenditure both are important for business for earning a profit in the present as well as in subsequent years. Usually the cost is recorded in a balance sheet account that is reported under the heading of property plant and equipment. Revenue expenditures and capital expenditures are both completely different things as a one. Both have benefits for business.

The cost of acquisition not only includes the cost of purchases but also any additional costs incurred in bringing the fixed asset into its present location and condition e g. Revenue expenditures are charged to expense in the current period or shortly thereafter.