Definition Of Capital Expenditure And Revenue Expenditure

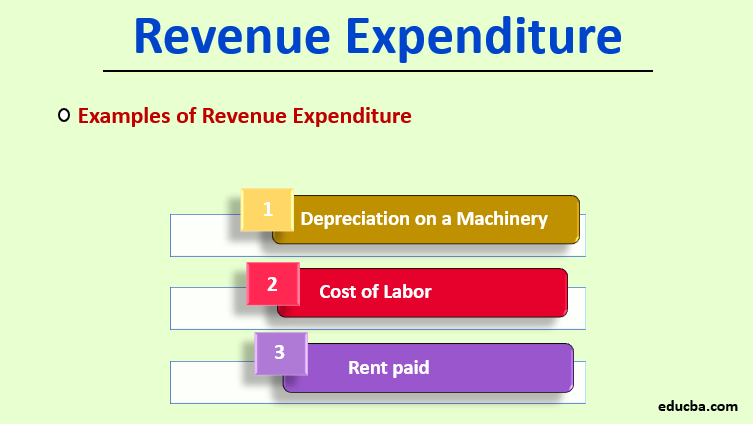

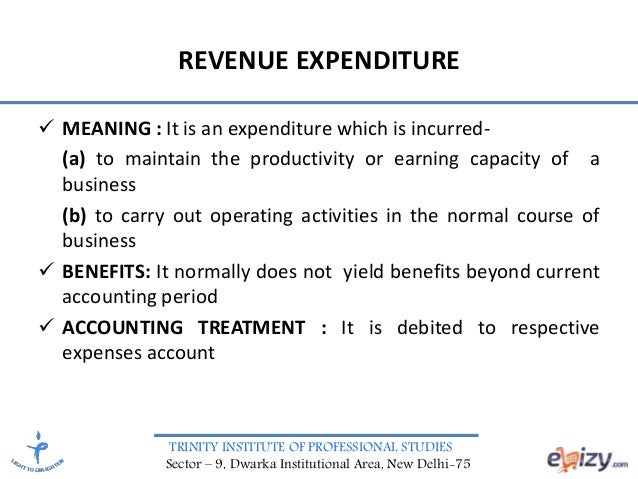

They re listed on the income statement to calculate the net profit of any accounting period.

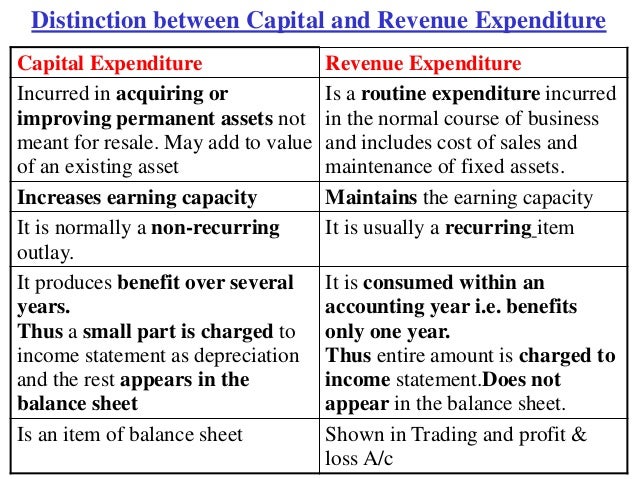

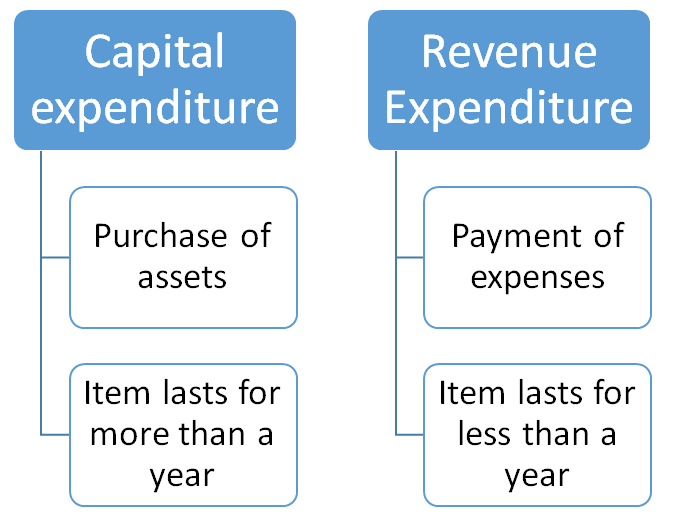

Definition of capital expenditure and revenue expenditure. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years. Usually the cost is recorded in a balance sheet account that is reported under the heading of property plant and equipment. Definition of capital expenditure. Revenue expenses are short term expenses to meet the ongoing operational costs of running a business.

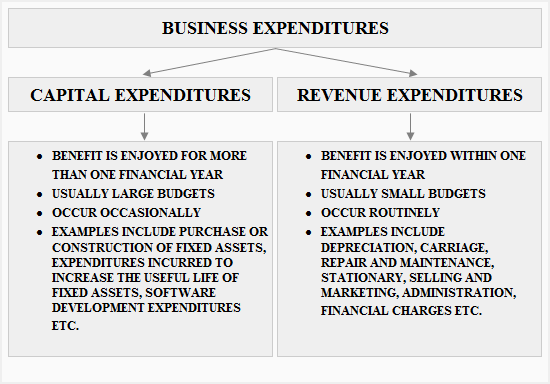

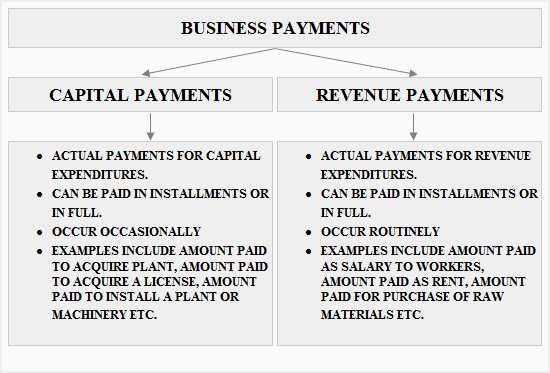

What is a capital expenditure versus a revenue expenditure. The amount spent by the company for possessing any long term capital asset or to enhance the working capacity of any existing capital asset or to increase its lifespan to generate future cash flows or to decrease the cost of production is known as capital expenditure. Capital and revenue expenditures are two different types of business expenditures that we often find in financial accounting and reporting. The business expenditures are of two types capital expenditures revenue expenditures capital expenditures definition and explanation of capital expenditures.

Revenue expenditure is a periodic investment of money that does not benefit the business nor leads to any loss in any way. While on the other hand capital expenditure is the long term investment that only benefits the business. Capital expenditures are major investments of capital to expand a company s business. Capital expenditure definition explanation and examples.

Plus capital expenditures will show up differently on your reporting metrics. Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible. Revenue expenditures and capital expenditures are both completely different things as a one. Expenditure is an amount incurred by a business to purchase assets and reduction of liabilities of business.

Definition of capital expenditure. Revenue expenditures are matched against revenues each month it is not reflected on the balance sheet the way a capital expenditure is. A business expenditure is an outflow of economic resources mostly in the form of cash and cash equivalents as a result of undertaking various activities during the normal course of business and to further the. A capital expenditure is an amount spent to acquire or significantly improve the capacity or capabilities of a long term asset such as equipment or buildings.

They break down differently depending on the size of the payment and the time across which it needs to be paid for.