Difference Between Capital Expenditure And Revenue Expenditure Class 11

Capital expenditures possess physical significance except for intangible assets.

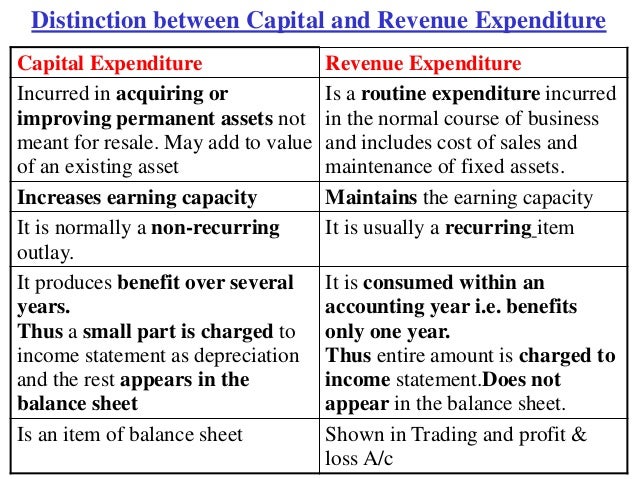

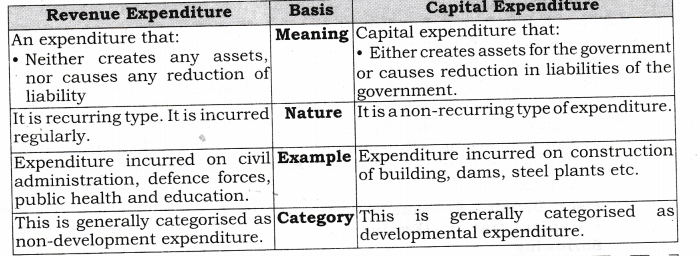

Difference between capital expenditure and revenue expenditure class 11. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning capacity of business and revenue expenditure is aimed at maintaining that earning capacity. Iii a purchase of a new machine is a capital expenditure which will enhance the firm s earning space. These might include plants property and equipment pp e like buildings machinery and office infrastructure. Revenue expenditures and capital expenditures are both completely different things as a one.

To understand the main differences between the two they have been further elaborated on the following points. Key differences between capital and revenue expenditure. Capital expenditures are usually non recurring in nature. I 7 500 loss in the furniture sale is revenue expenditure and 6 050 purchase cartage will be capital expenditure.

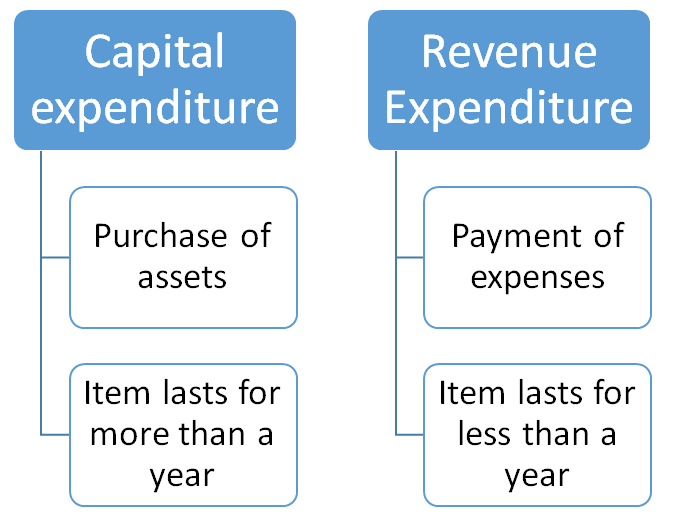

Examples of differences between capital and revenue expenditure. A capital expenditure is money spent to buy fixed assets. B revenue expenditure is money spent on the daily running expenses of the business. Revenue expenditure is a periodic investment of money that does not benefit the business nor leads to any loss in any way.

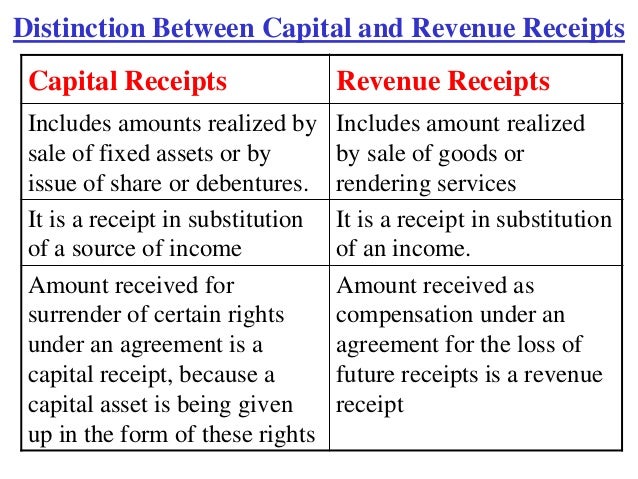

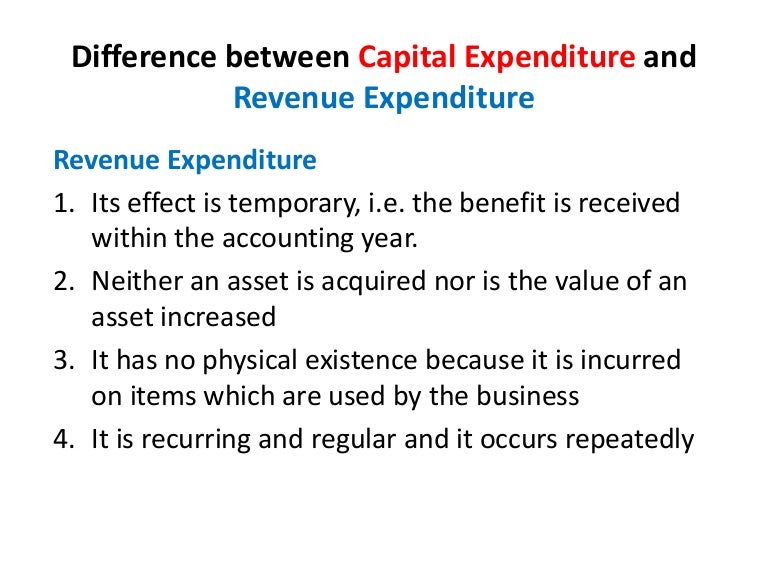

Capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. Capital expenditure revenue expenditure. Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence. On the contrary revenue expenditure occurs frequently.

Ii it is considered as capital expenditure as registration and a legal fee is given to obtain the asset. The major difference between the two is that the capital expenditure is a one time investment of money. Capital expenditure or capex refers to the funds used by a business to acquire maintain and upgrade fixed assets. This distinction between capital and revenue nature of the items is necessary in order to find out the correct profit or loss during the year and also to ascertain the true and fair position of the business.

Capital expenditures add value to existing assets. Capital versus revenue expenditure. The going concern assumption allows the accountant to classify the expenditure as capital expenditures and revenue expenditures capital receipts and capital revenues. Revenue expenditures are usually recurring in nature.

Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term. Revenue expenditures have no physical significance. Purchase a building rent a building.