Difference Between Capital Expenditure And Revenue Expenditure Class 12

Capital expenditures capex are funds used by a.

Difference between capital expenditure and revenue expenditure class 12. Capital versus revenue expenditure. Per user per month 9 7. At vedantu we hope that the above discussion on the differences between revenue and capital expenditure has helped to instil a clear idea on the topic. The going concern assumption allows the accountant to classify the expenditure as capital expenditures and revenue expenditures capital receipts and capital revenues.

Difference between capital and revenue expenditure class 12 accountancy watch this video to know the difference between capital and revenue expenditure income profit and losses. These can be paid in cash or credit or in kind. To know the difference between capital and revenue expenditures we have to know the meaning of both terms. Make sure to visit our official website to join our fun and interactive learning program.

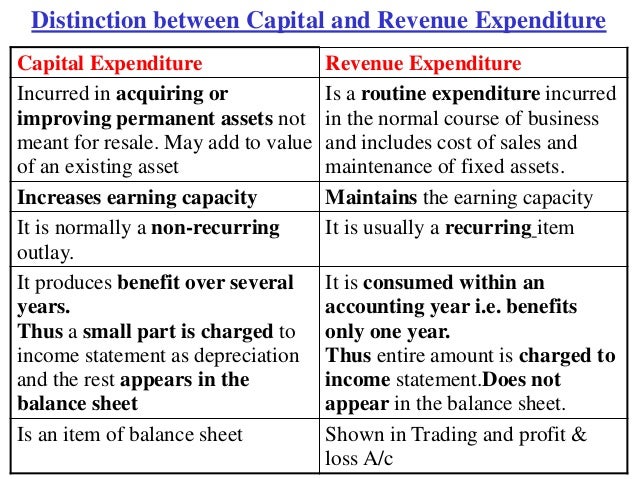

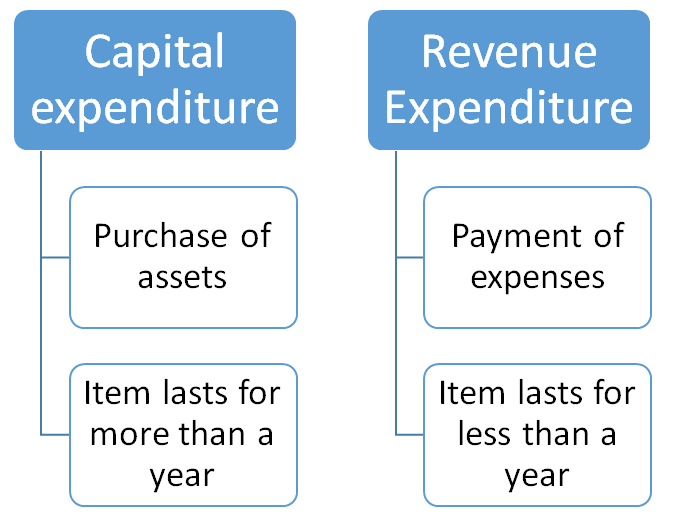

What is the difference between a capital expenditure and a revenue expenditure. Learn the difference between capital expenditures and revenue expenditures. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term. We offer study material on other chapters of class 11 12 commerce.

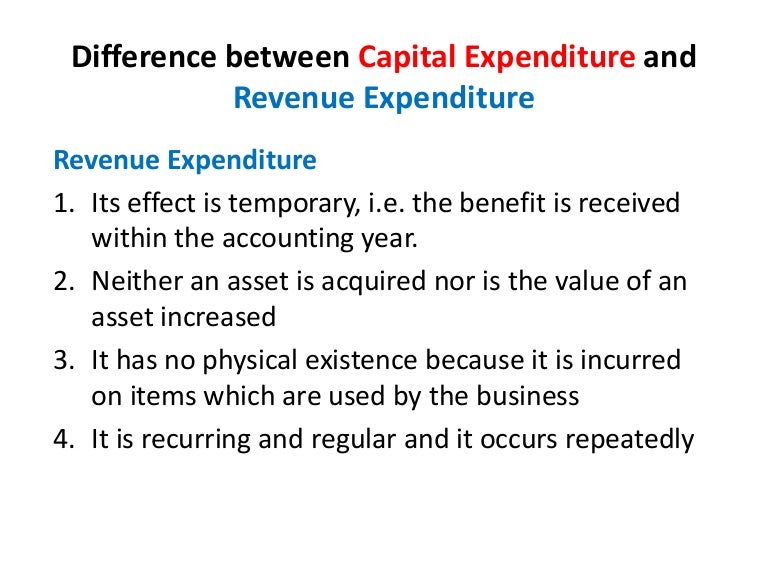

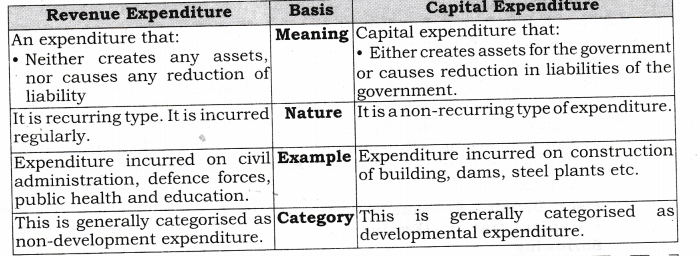

The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. This distinction between capital and revenue nature of the items is necessary in order to find out the correct profit or loss during the year and also to ascertain the true and fair position of the business. Learn the difference between capital expenditures and revenue expenditures. Expenditures meaning spends or will be spent some amount on the purchase of goods and avail services.

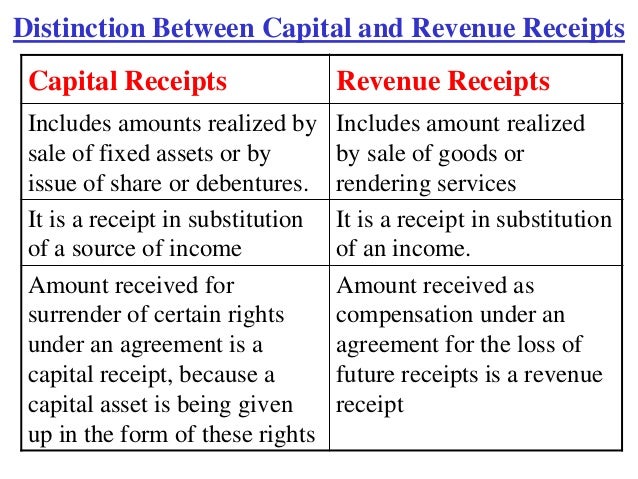

Know how to account for them to improve the financial health of your business. The difference between capital expenditure and revenue expenditure are expained in tabular form. Capital expenditure revenue expenditure. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term.

Difference between capital expenditure and revenue expenditure. Examples of differences between capital and revenue expenditure. Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence. A capital expenditure is money spent to buy fixed assets.