Difference Between Capital Expenditure And Revenue Expenditure In Accounting

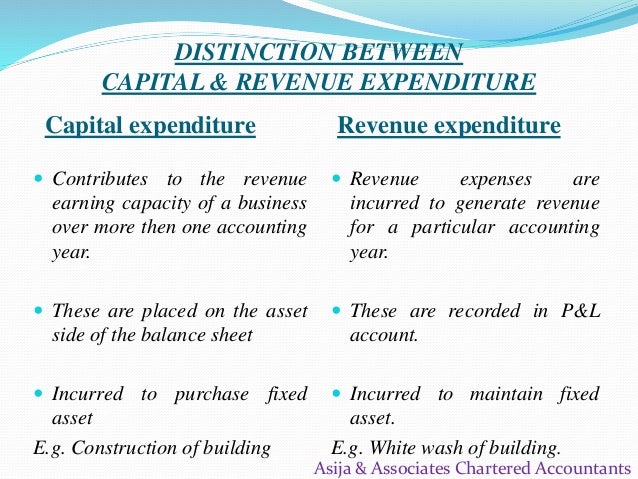

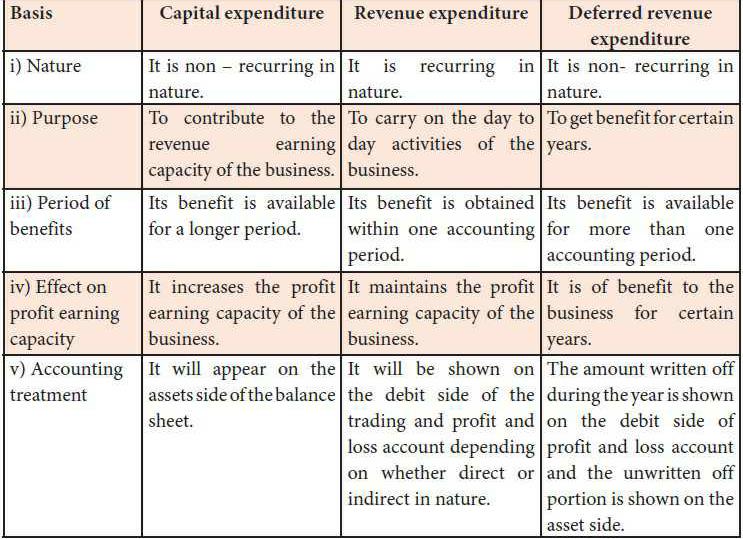

It must be noted here that capital expenditure is capitalised.

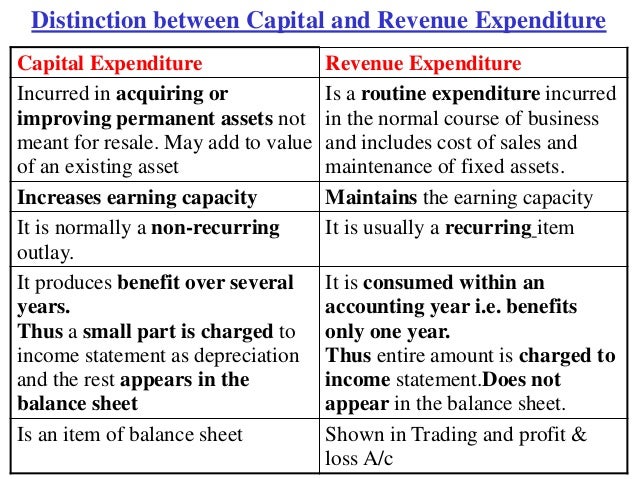

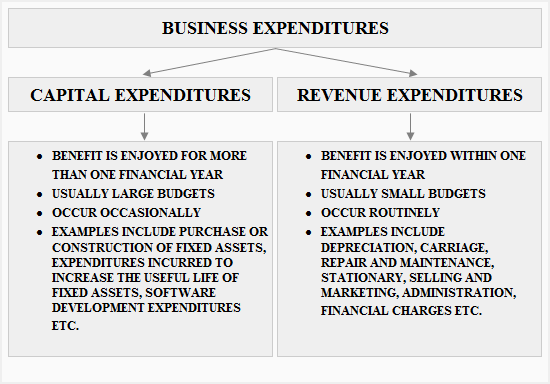

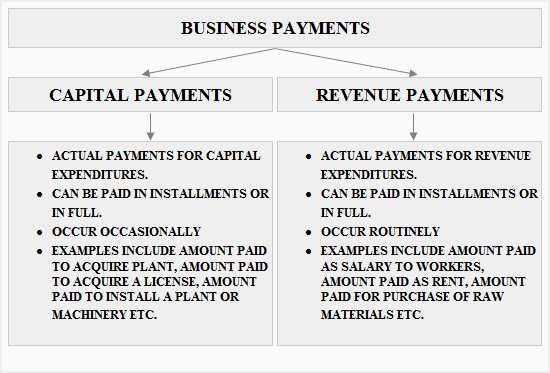

Difference between capital expenditure and revenue expenditure in accounting. Further depreciation is charged on capex every year and is among the prominent differences between capital expenditure and revenue expenditure. The difference between capital expenditure and revenue expenditure are expained in tabular form. Capital expenditures are for fixed assets which are expected to be productive assets for a long period of time. Differences between capital expenditure and revenue expenditure.

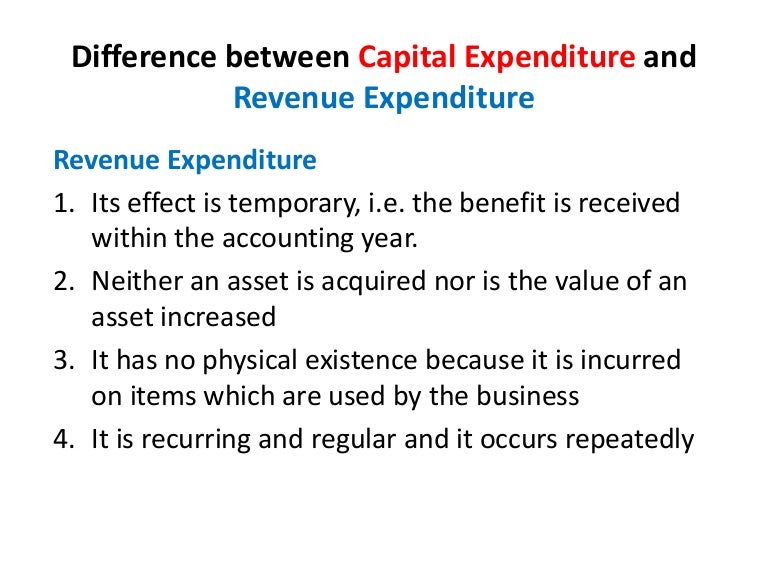

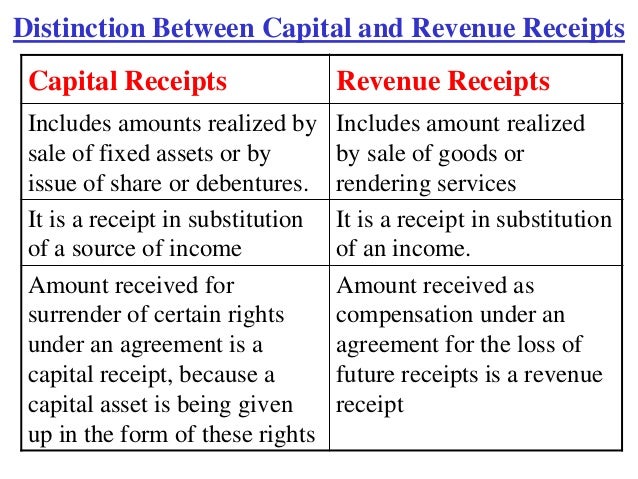

Capital expenditures capex are funds used by a. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term. Capacity of business and revenue expenditure is aimed at maintaining that earning capacity. Revenue expenditures are for costs that are related to specific revenue transactions or operating periods such as the cost of goods sold or repairs and maintenance expense thus the differences between these two types of expenditures are as follows.

Capital expenditure is divided into these 3 distinct groups expenses that a firm incurs to lower cost. Business expenditures are accounted for in either one of the two ways. Types of capital expenditure. They are either expensed in the income statement revenue expenditures or capitalized as fixed assets in the balance sheet capital expenditures.