Difference Between Capital Expenditure And Revenue Expenditure In Hindi

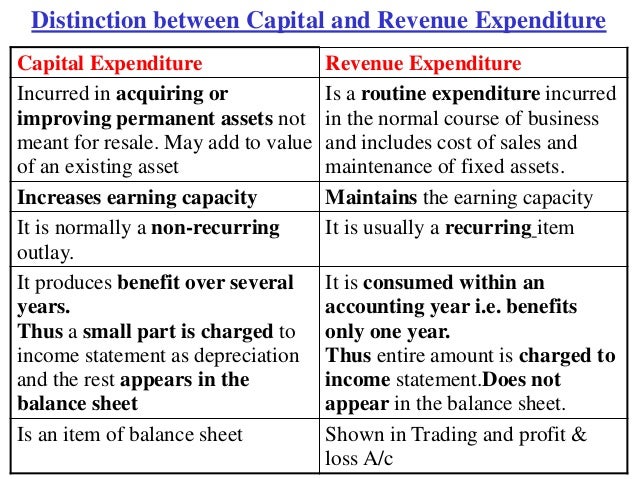

Further depreciation is charged on capex every year and is among the prominent differences between capital expenditure and revenue expenditure.

Difference between capital expenditure and revenue expenditure in hindi. Capital expenditures capex are funds used by a. The most important difference between capital expenditure and revenue expenditure is that the former is aimed at improving overall earning capacity of the concern whereas the latter tries to maintain the earning capacity. It must be noted here that capital expenditure is capitalised. Urdu hindi my recommenmd amazing gears products.

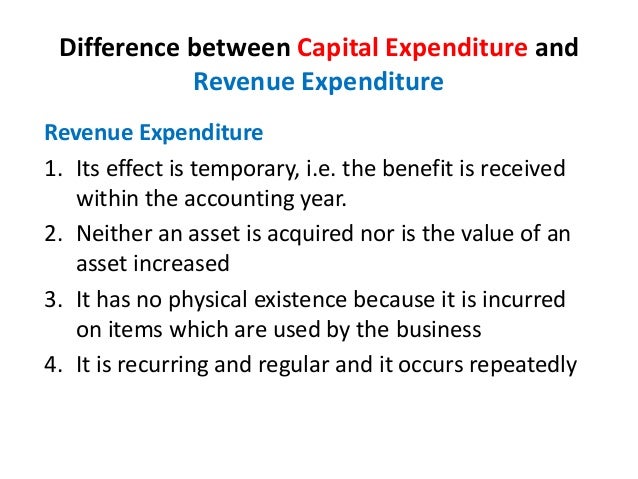

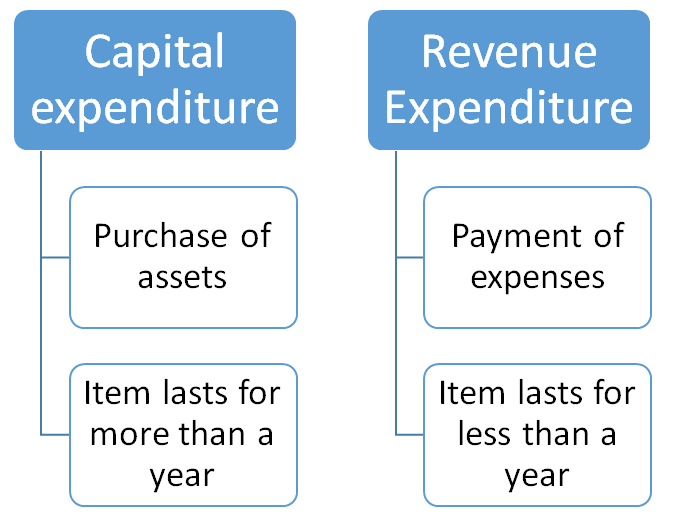

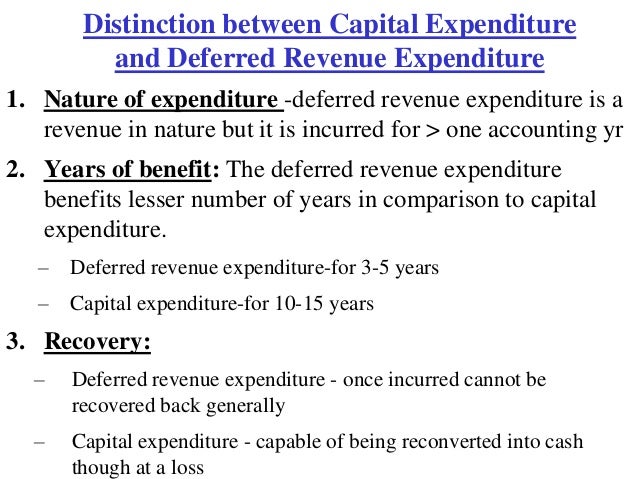

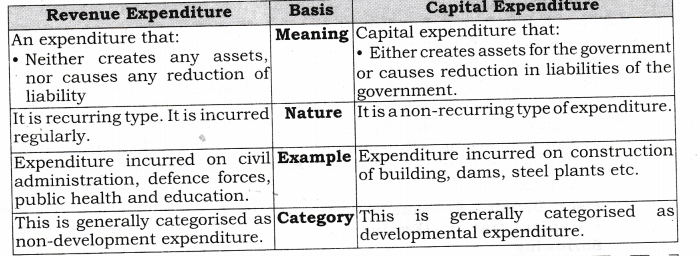

Have a glance at the article in which we ve elaborated some more points of difference. The main difference between capital expenditure and revenue expenditure is that capital expenditure is assumed to consume over the useful life of the related fixed asset whereas revenue expenditure is assumed to consumed within a very short period. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning capacity of business and revenue expenditure is aimed at maintaining that earning capacity. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term.

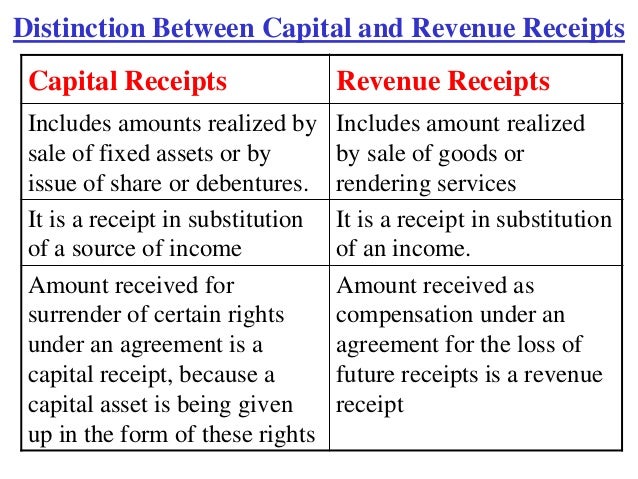

Expenditure is defined as payments of cash or cash equivalent for goods or services or a charge against available funds in settlement of an obligation as evidenced by. Operating expenditures expenses represent day to day costs that are necessary to keep a business running. This video give the basic concept basic logic s difference between capital expenditures revenue expenditures. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term.

The post difference between capital expenditure and revenue expenditure in hindi appeared first on best tally accounts finance taxation sap fi coaching institute in dehradun. This post first appeared on coaching tally accounts finance taxation bankin please read the originial post. Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence. Capital expenditures comprise major purchases that will be used in the future.

Capital expenditure vs revenue expenditure.