Difference Between Capital Expenditure And Revenue Expenditure In Income Tax

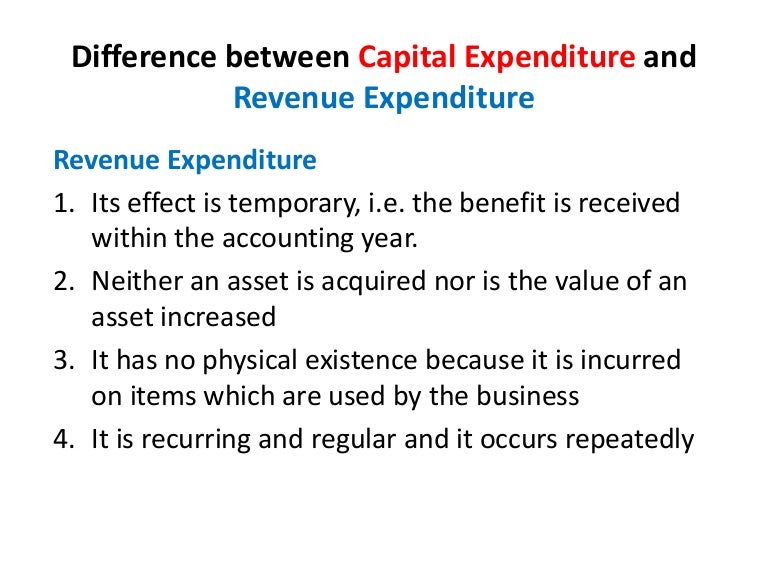

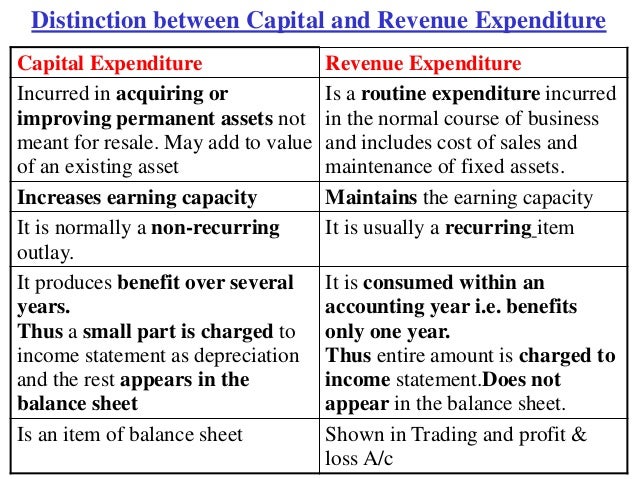

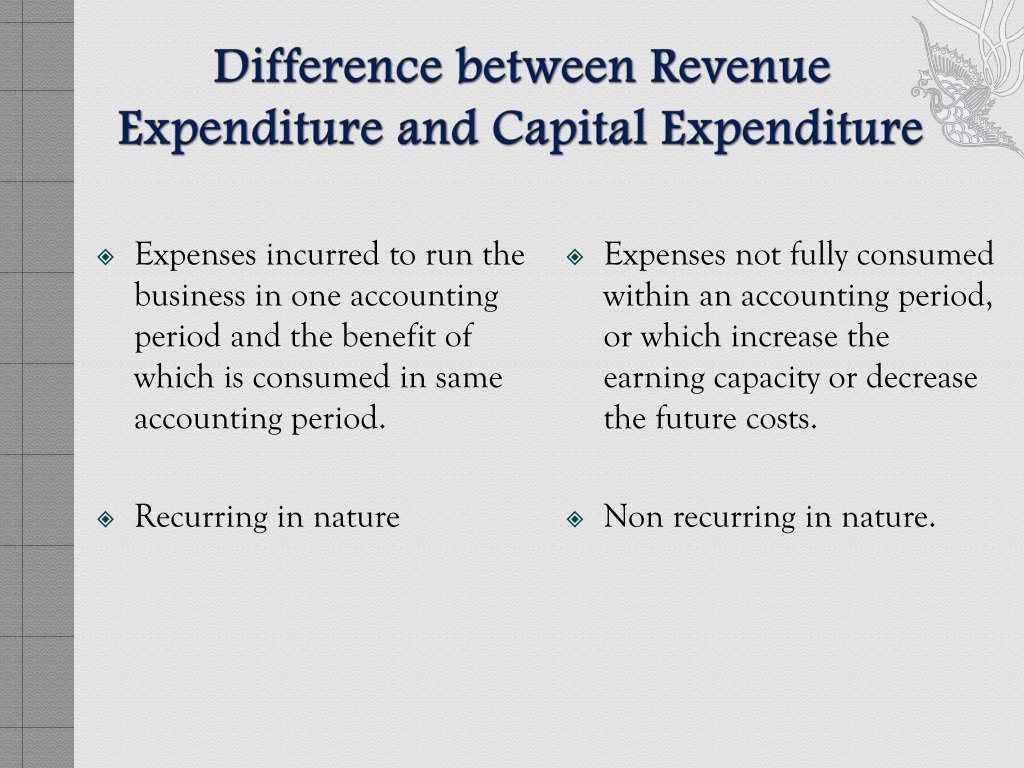

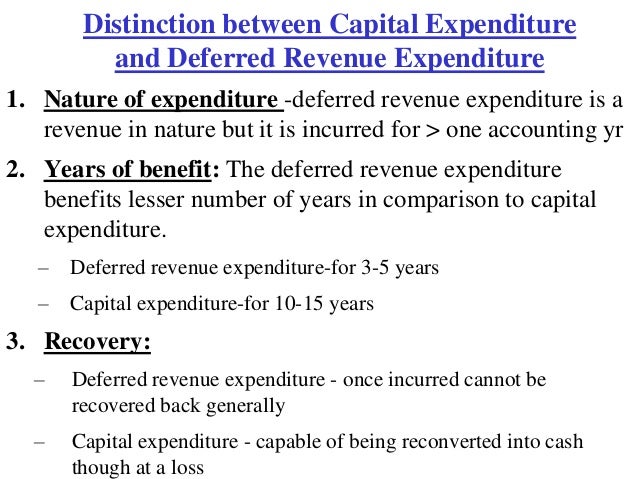

Iii capital expenditure is normally a non recurring outlay but revenue expenditure is usually a recurring features.

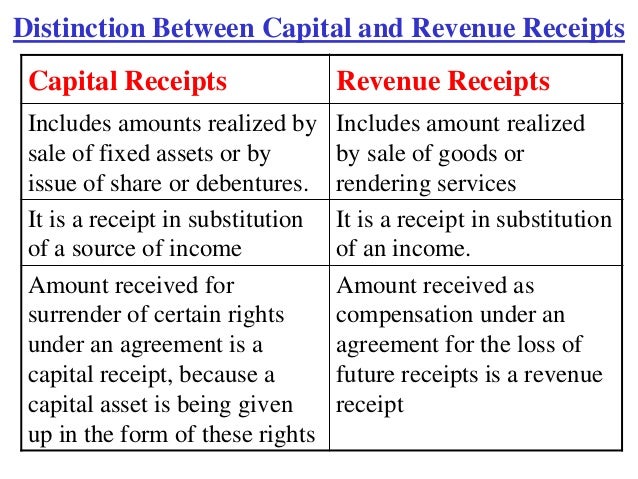

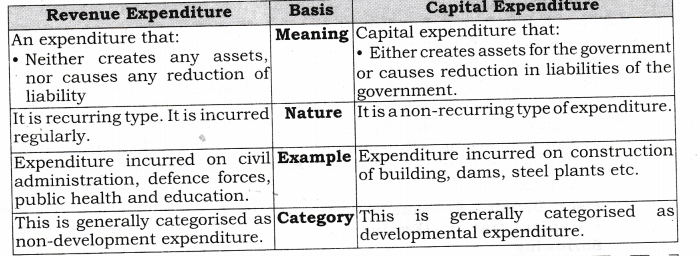

Difference between capital expenditure and revenue expenditure in income tax. The going concern assumption allows the accountant to classify the expenditure as capital expenditures and revenue expenditures capital receipts and capital revenues. As such revenue expenditure is charged to the income statement when it occurs. Revenue or capital the income tax act does not define the terms revenue expenditure and capital expenditure so one has to depend on their natural meaning and as well as on decided cases to interpret. Differences between capital expenditure and revenue expenditure.

To place the expenditure properly in the financial statements as per their nature i e. Capital expenditure is divided into these 3 distinct groups expenses that a firm incurs to lower cost. Contrariwise revenue expenditure not shown on the balance sheet. They are matched against the revenues in that same time period and deducted from those revenues.

Capital expenditure does not decrease the revenue of the business. Iv capital expenditure produces benefits over several years. The difference between capital expenditure and revenue expenditure are expained in tabular form. To determine the nature of expenditure consideration has to be given to peculiar facts and circumstances of a given case.

Further depreciation is charged on capex every year and is among the prominent differences between capital expenditure and revenue expenditure. Capital expenditures capex are funds used by a. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term. Revenue expenditure is taken into account while computing taxable profits and would be eligible for a tax deduction whereas on capital expenditure only depreciation can be claimed.

A revenue expenditure or income statement expenditure refers to expenses that are charged to expense accounts as soon as they re incurred on a day to day basis. The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. Hence only a small part is charged as depreciation to income statement and the rest appears in the balance sheet. Types of capital expenditure.

It must be noted here that capital expenditure is capitalised. This distinction between capital and revenue nature of the items is necessary in order to find out the correct profit or loss during the year and also to ascertain the true and fair position of the business. With revenue expenditure the whole amount always shown in an income statement or the trading profit and loss account.