Difference Between Capital Expenditure And Revenue Expenditure With Basis

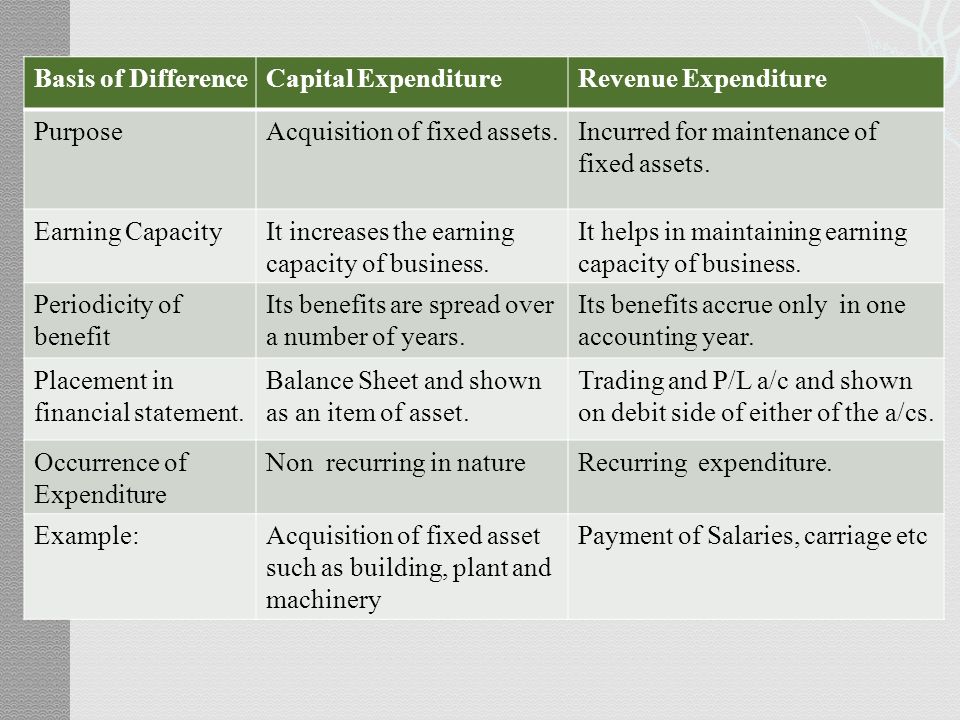

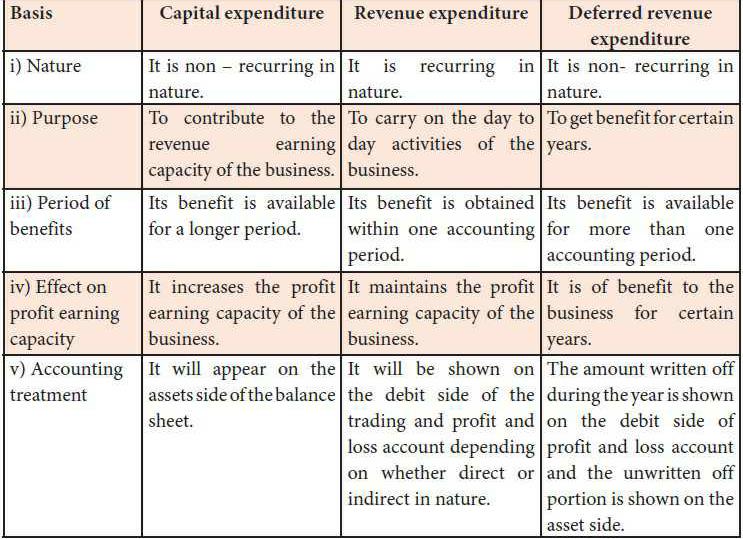

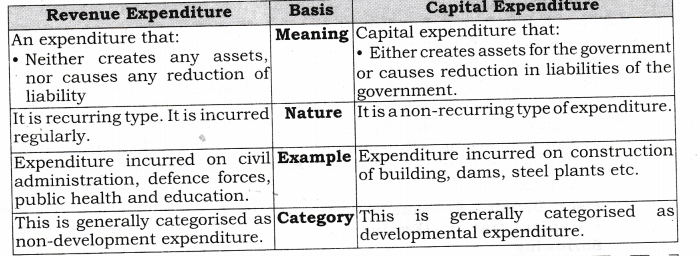

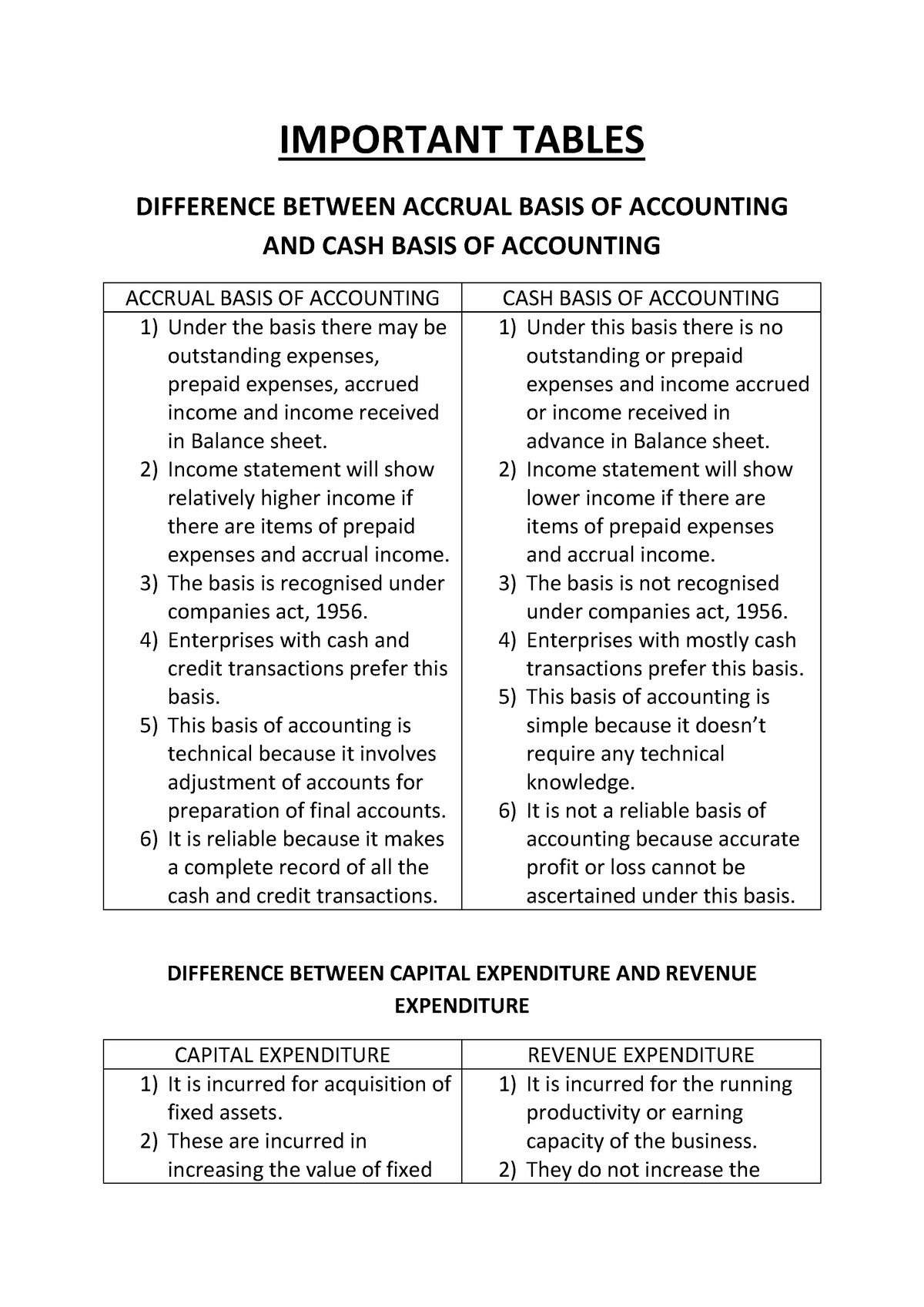

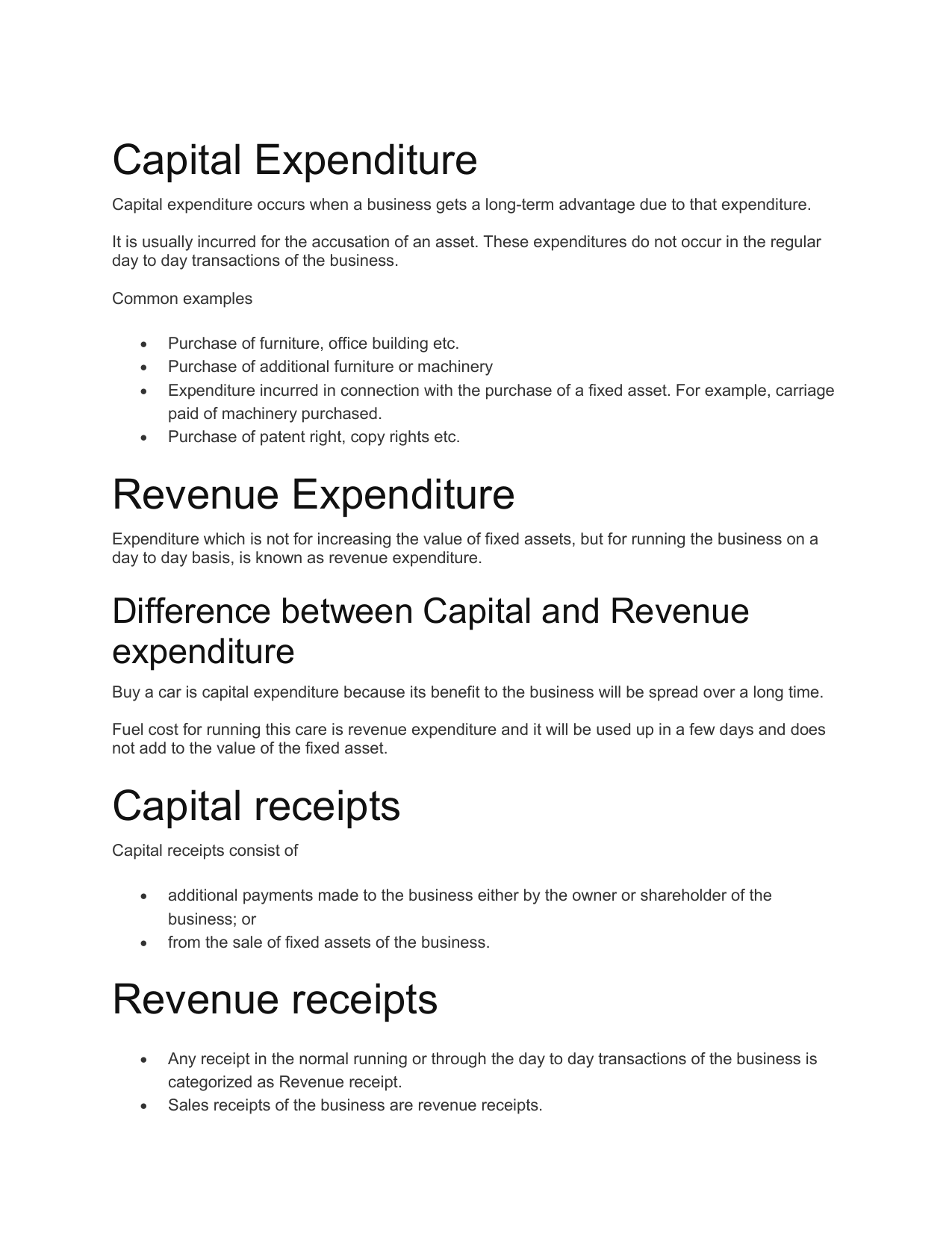

The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term.

Difference between capital expenditure and revenue expenditure with basis. Revenue expenditures are simply normal business expenses business costs incurred during normal business operations. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning. Types of capital expenditure. The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only.

Capital expenditure is divided into these 3 distinct groups expenses that a firm incurs to lower cost. It must be noted here that capital expenditure is capitalised. Further depreciation is charged on capex every year and is among the prominent differences between capital expenditure and revenue expenditure.