Difference Between Capital Expenditure And Revenue Expenditure With Examples Pdf

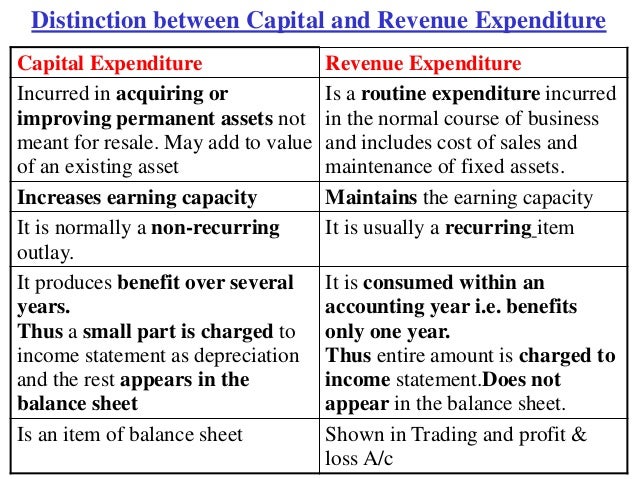

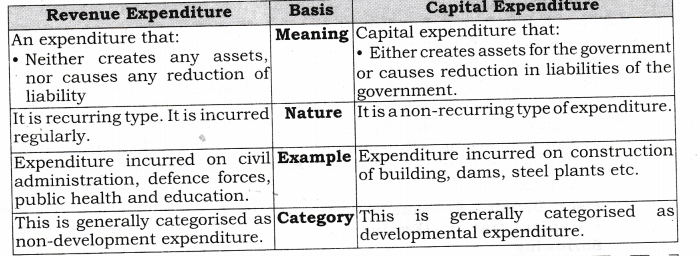

Capital expenditure results in the increase of earning capacity of the organization.

Difference between capital expenditure and revenue expenditure with examples pdf. Rs 20000 spent on the repairs of machine is a capital expenditure b revenue expenditure c deferred revenue expenditure d miscellaneous 7. On the contrary revenue expenditure occurs frequently. An expenditure is a capital expenditure if the benefit of the expenditure extends to several trading years. I wages paid on the purchase of goods.

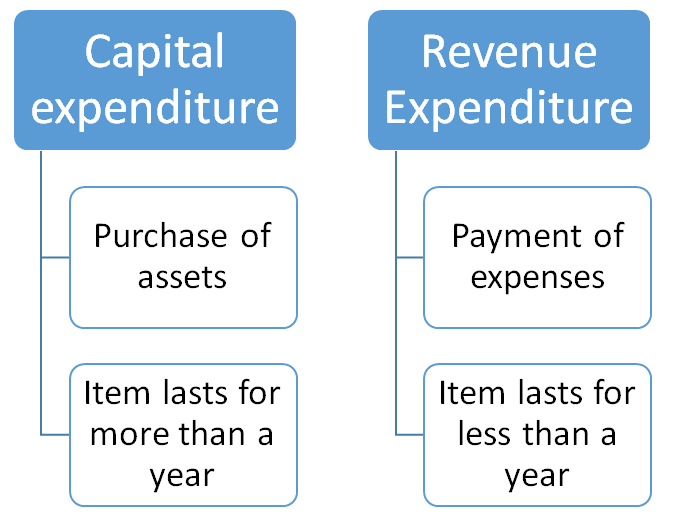

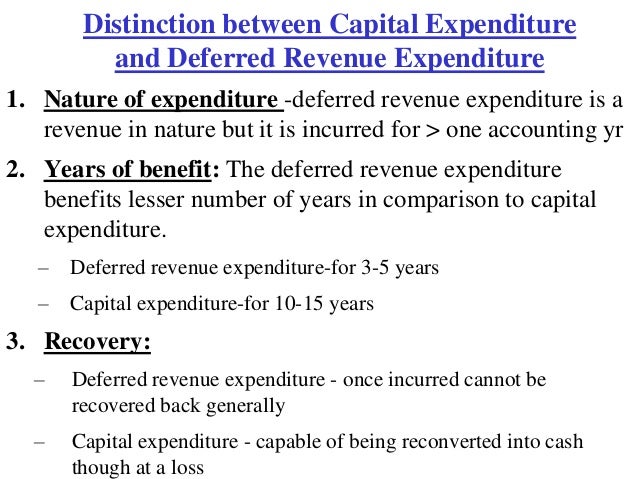

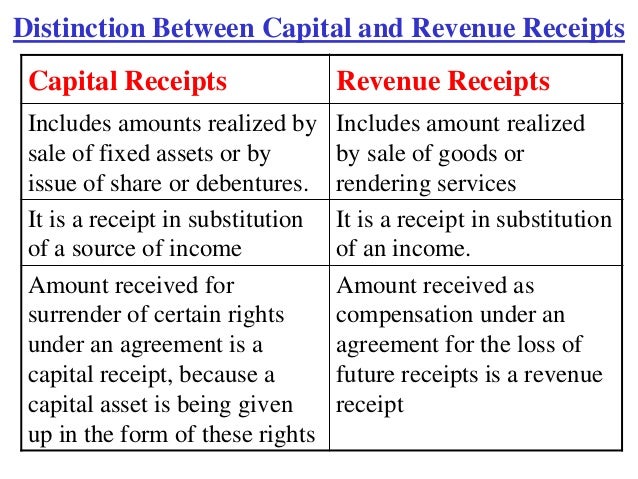

The business expenditures are of two types capital expenditures revenue expenditures capital expenditures definition and explanation of capital expenditures. Capital expenditure may include the following expenditures expenditure incurred on the acquisition of fixed assets tangible. To understand the main differences between the two they have been further elaborated on the following points. Examples of differences between capital and revenue expenditure.

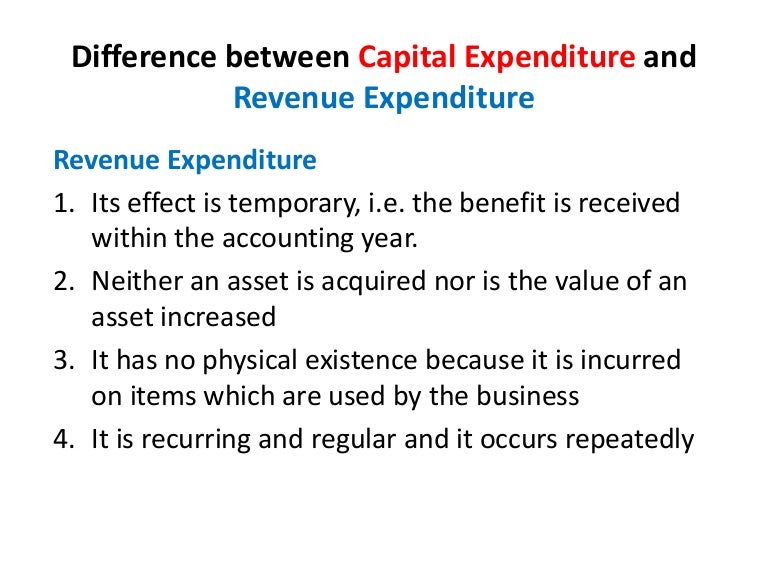

Capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. Capital expenditures are major investments of capital to expand a company s business. The main difference between capital expenditure and revenue expenditure is that capital expenditure is assumed to consume over the useful life of the related fixed asset whereas revenue expenditure is assumed to consumed within a very short period. Revenue expenditure is the expenditure incurred for day to day operations of the business and also for maintenance of fixed assets.

Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence. Revenue expenses are short term expenses to meet the ongoing operational costs of running a business. Capital expenditure is the expenditure incurred for the purchase of fixed assets. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term.

Capital versus revenue expenditure. A capital expenditure is money spent to buy fixed assets. Key differences between capital and revenue expenditure. State with reasons whether the fallowing items of expenditure are capital or revenue.

Capital expenditure revenue expenditure. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning capacity of business and revenue expenditure is aimed at maintaining that earning capacity. B revenue expenditure is money spent on the daily running expenses of the business.