Difference Between Capital Expenditure And Revenue Expenditure With Examples

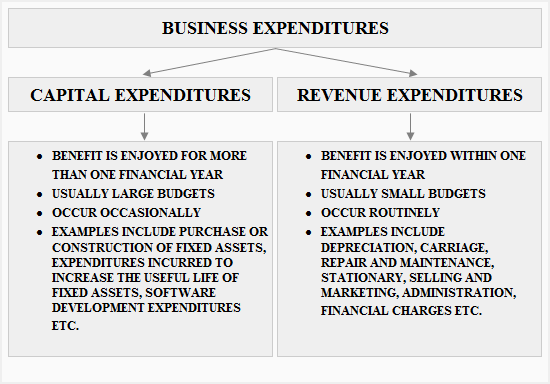

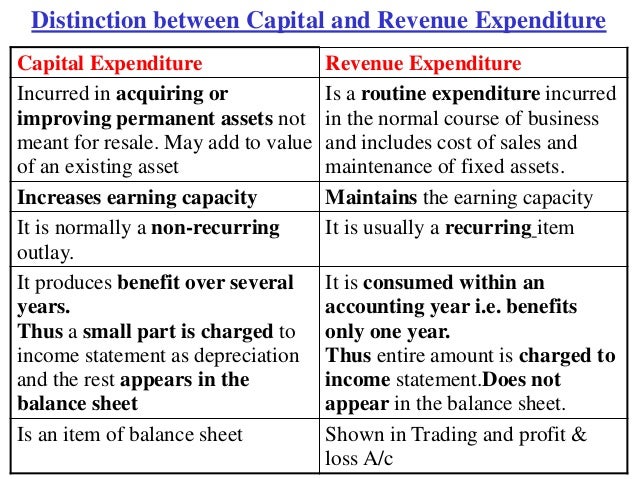

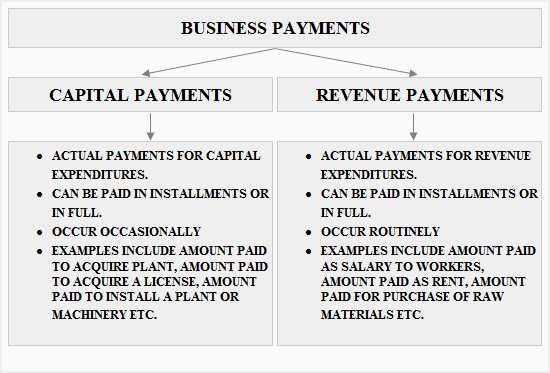

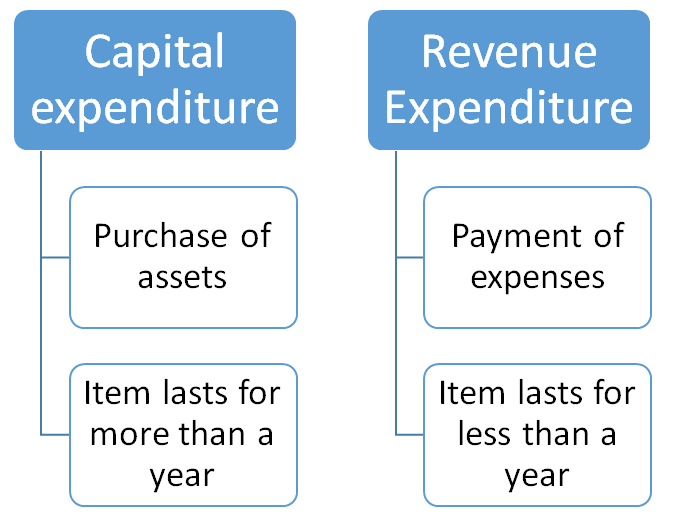

The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term.

Difference between capital expenditure and revenue expenditure with examples. The main difference between capital expenditure and revenue expenditure is that capital expenditure is assumed to consume over the useful life of the related fixed asset whereas revenue expenditure is assumed to consumed within a very short period. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term. Understanding how each should be tracked can mean big savings over time and should be a firm part of your accounting strategy. Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence.

The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning. Capital expenditure or capex refers to the funds used by a business to acquire maintain and upgrade fixed assets. Capacity of business and revenue expenditure is aimed at maintaining that earning capacity. Differences between capital expenditure and revenue expenditure.

The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. The difference between revenue expenditures and capital expenditures is another example of two similar terms that are easily mixed up.