Differentiate Between Capital Expenditure And Revenue Expenditure Give Two Examples Of Each

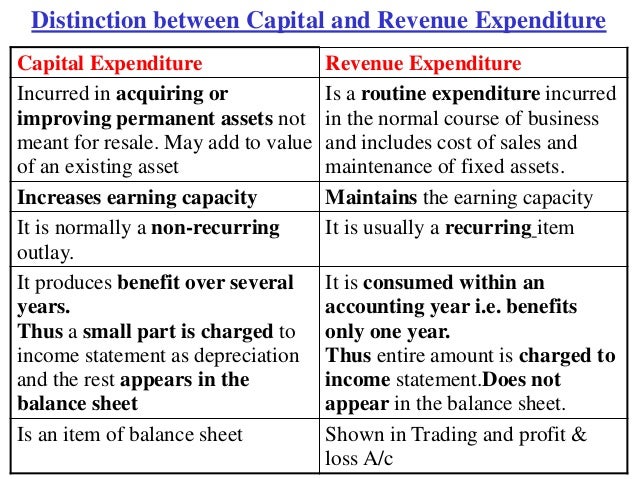

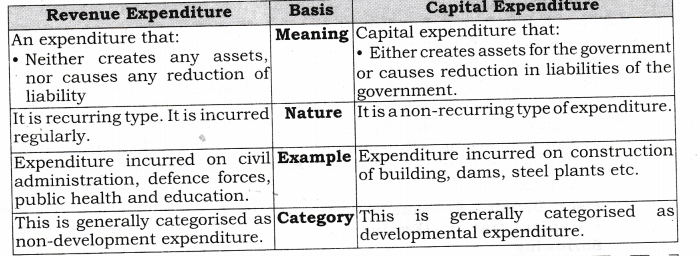

Capital expenditure is shown in the balance sheet in asset side and in the income statement depreciation but revenue expenditure is shown only in the income statement.

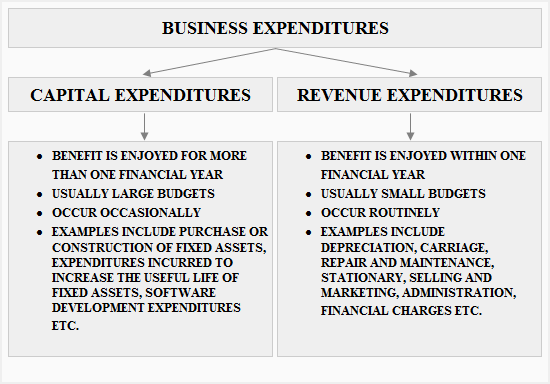

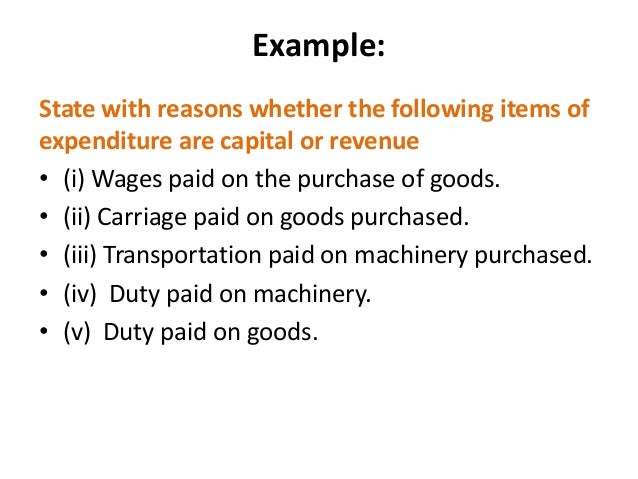

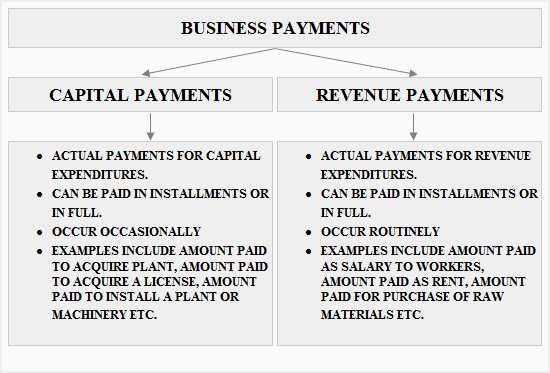

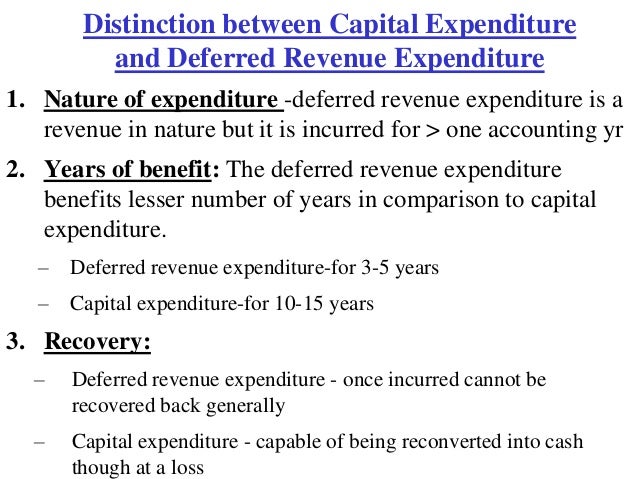

Differentiate between capital expenditure and revenue expenditure give two examples of each. Revenue expenditures are for costs that are related to specific revenue transactions or operating periods such as the cost of goods sold or repairs and maintenance expense thus the differences between these two types of expenditures are as follows. On the contrary revenue expenditure occurs frequently. Differentiate between a revenue expenditure and a capital expenditure. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term.

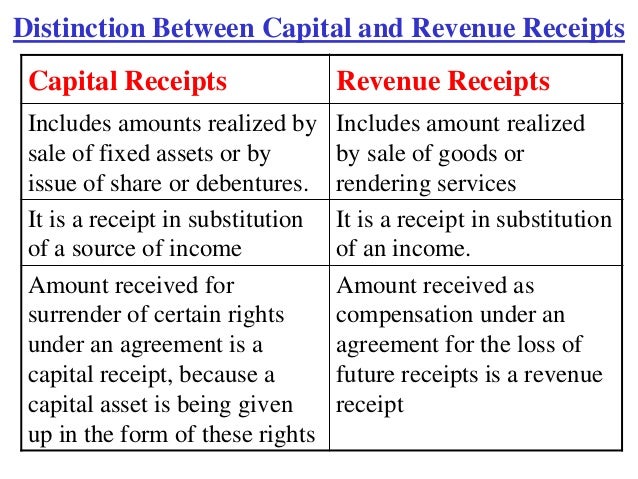

Compensation paid to the director of a company for the loss of his office is a revenue expenditure because the company will get the benefit of this expenditure only for one year. Every organization spends money for various purposes some expenses are incurred to gain more profits and some are for future profit requirements. Capital expenditures capex are funds used by a. The major difference between the two is that the capital expenditure is a one time investment of money.

Give an example of each. They re listed on the income statement to calculate the net profit of any accounting period. Difference between capital expenditure and revenue expenditure a business organisation incurs expenditures for various purposes during its existence. By signing up you ll get thousands of.

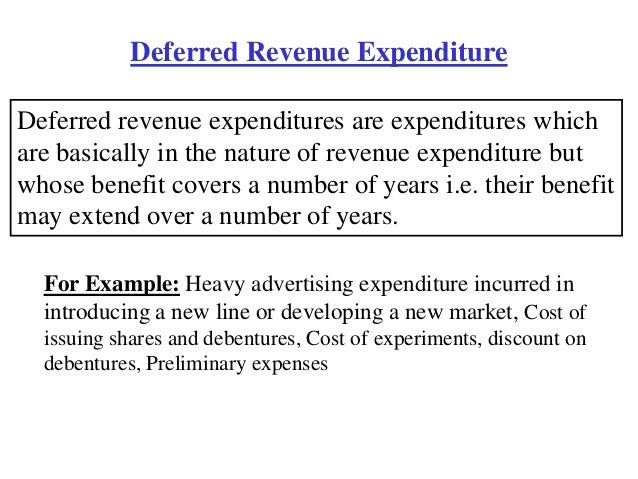

Every expenditure has its own purpose from the business point of view and the classification between the capital expenditures and revenue expenditures is the most regular common problem for accountants since it has a significant impact on financial. Capital expenditure is a long term expenditure and therefore has a long term effect on the business. The difference between revenue expenditures and capital expenditures is another example of two similar terms that are easily mixed up. Understanding how each should be tracked can mean big savings over time and should be a firm part of your accounting strategy.

Revenue expenditures are matched against revenues each month it is not reflected on the balance sheet the way a capital expenditure is. Capital expenditures are for fixed assets which are expected to be productive assets for a long period of time.