Differentiate Between Capital Expenditure And Revenue Expenditure

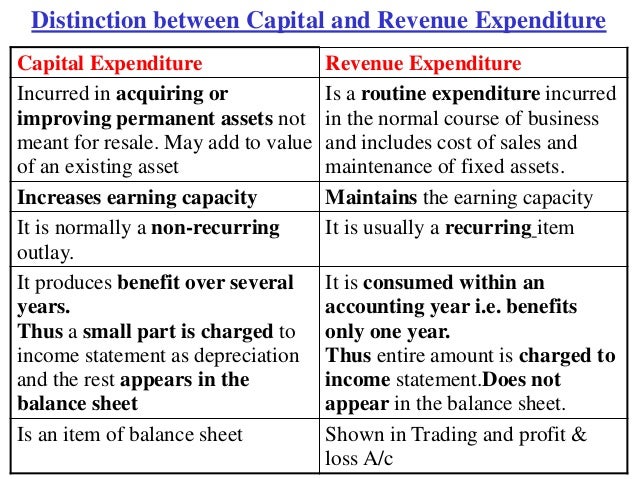

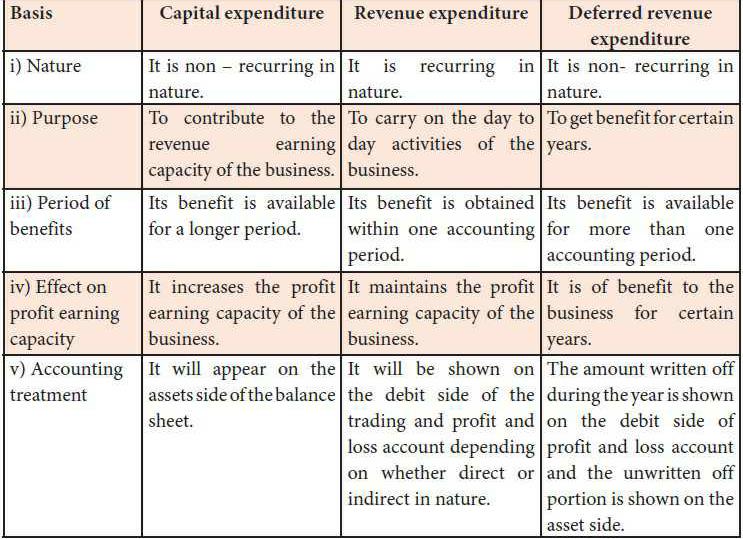

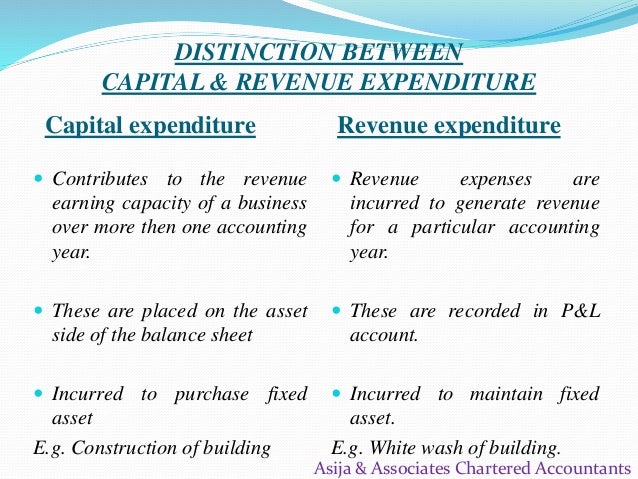

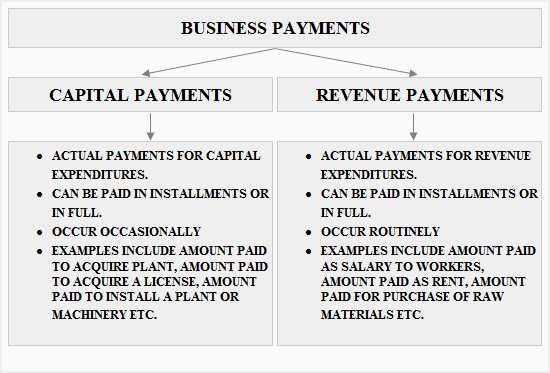

The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only.

Differentiate between capital expenditure and revenue expenditure. The most significant difference between revenue and capital expenditure is that the capital expenditure is meant to improve the general earning. The going concern assumption allows the accountant to classify the expenditure as capital expenditures and revenue expenditures capital receipts and capital revenues. The difference between capital expenditure and revenue expenditure are expained in tabular form. Types of capital expenditure.

Capital expenditures are for fixed assets which are expected to be productive assets for a long period of time. Differences between capital expenditure and revenue expenditure. Capital expenditure is divided into these 3 distinct groups expenses that a firm incurs to lower cost. Capacity of business and revenue expenditure is aimed at maintaining that earning capacity.

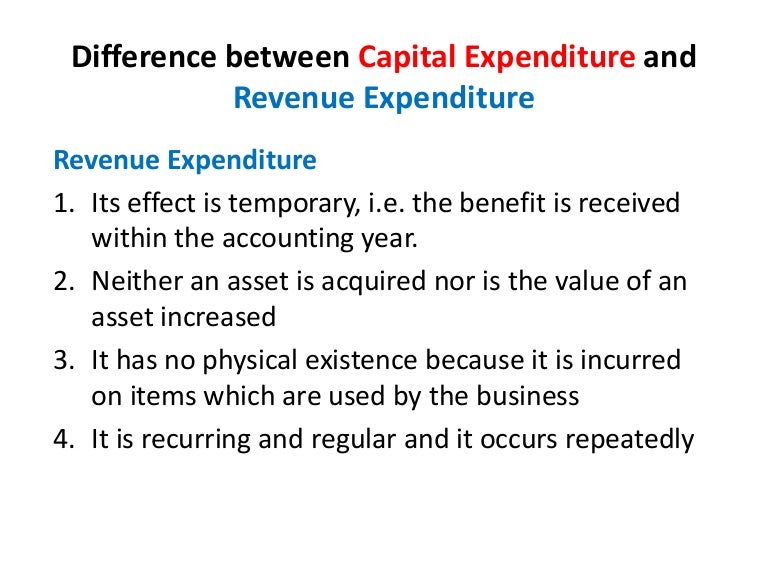

The main difference between capital expenditure and revenue expenditure is that capital expenditure is assumed to consume over the useful life of the related fixed asset whereas revenue expenditure is assumed to consumed within a very short period. Further depreciation is charged on capex every year and is among the prominent differences between capital expenditure and revenue expenditure. It must be noted here that capital expenditure is capitalised. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term.

This distinction between capital and revenue nature of the items is necessary in order to find out the correct profit or loss during the year and also to ascertain the true and fair position of the business. Compensation paid to the director of a company for the loss of his office is a revenue expenditure because the company will get the benefit of this expenditure only for one year. Capital expenditures capex are funds used by a. Some of these expenditures are meant to bring in more profits for the organisation in the long term while some expenditures are for the short term.

These might include plants property and equipment pp e like buildings machinery and office infrastructure.