Distinguish Between Capital Expenditure And Revenue Expenditure With Examples

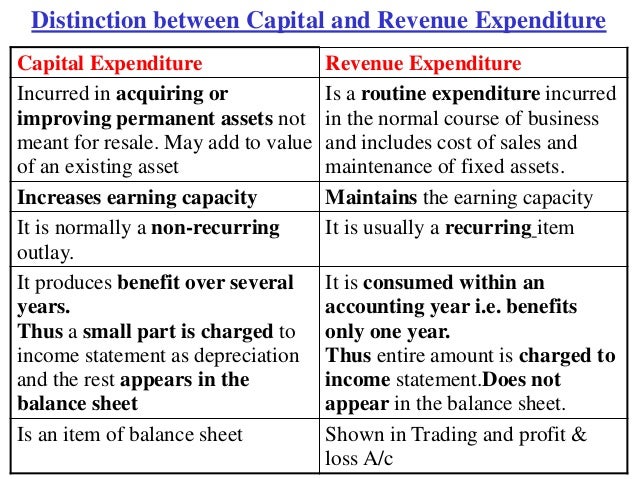

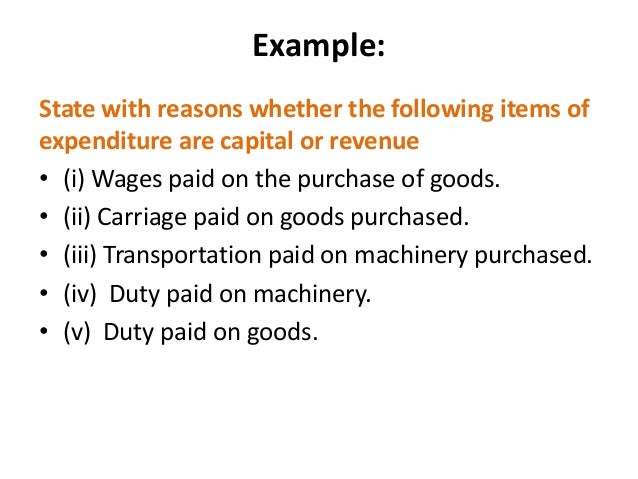

Every expenditure has its own purpose from the business point of view and the classification between the capital expenditures and revenue expenditures is the most regular common problem for accountants since it has a significant impact on financial.

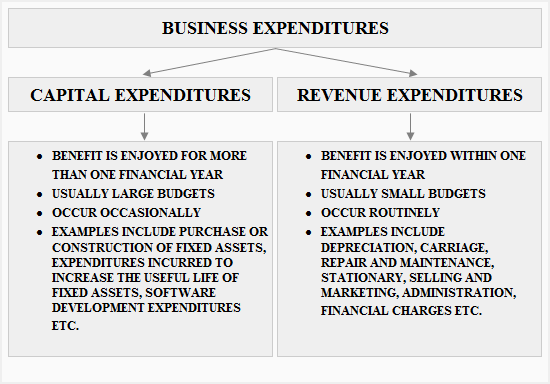

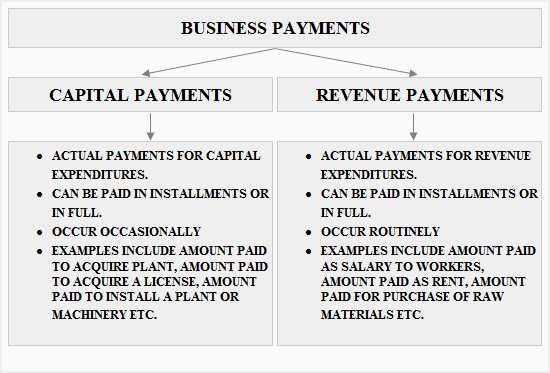

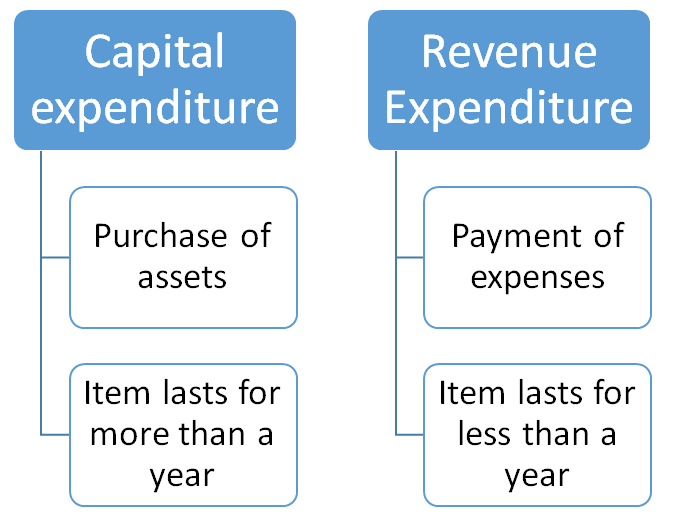

Distinguish between capital expenditure and revenue expenditure with examples. Capital expenditure or capex refers to the funds used by a business to acquire maintain and upgrade fixed assets. Every organization spends money for various purposes some expenses are incurred to gain more profits and some are for future profit requirements. Capital expenditures capex are funds used by a. Capacity of business and revenue expenditure is aimed at maintaining that earning capacity.

The first and foremost difference between the two is capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only. Differences between capital expenditure and revenue expenditure. The differences between capital expenditures and revenue expenditures include whether the purchases will be used over the long term or short term.