Epf Contribution Rate 2019 20 Calculator

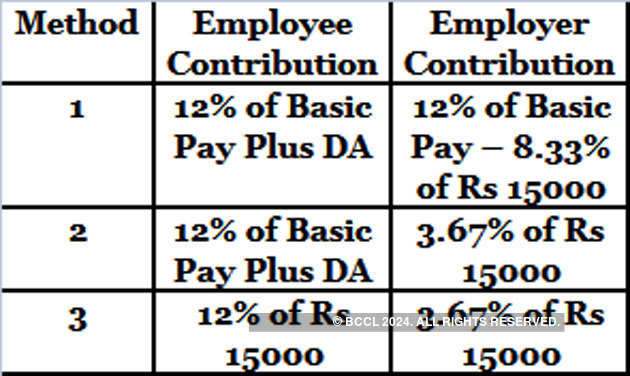

With this 172 categories of industries establishments out of 177 categories notified were to pay provident fund contribution 10 w e f.

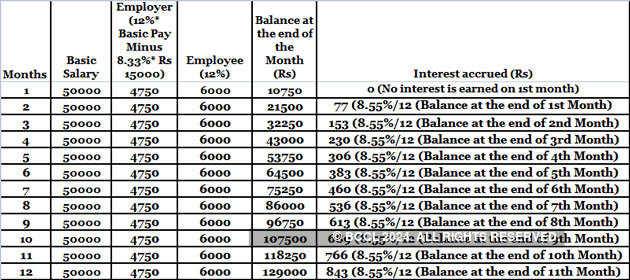

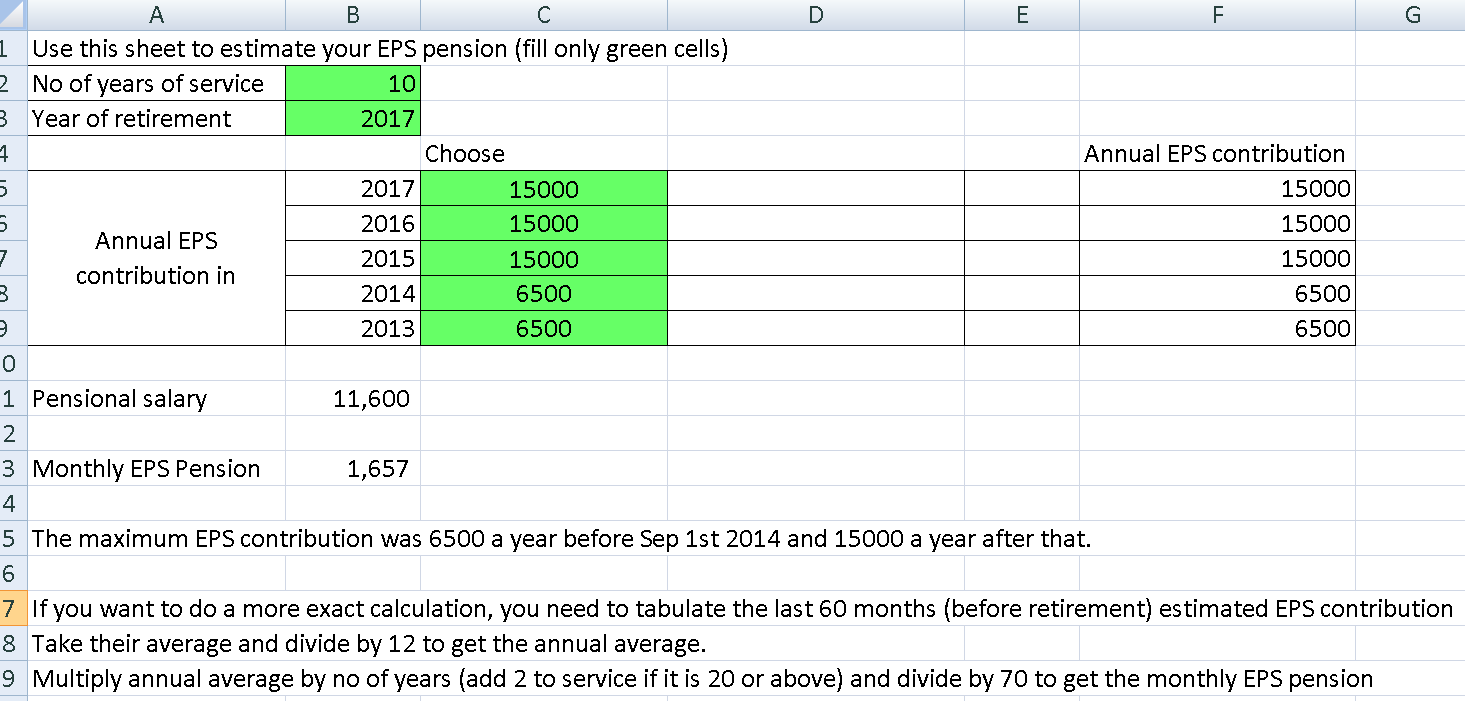

Epf contribution rate 2019 20 calculator. The calculator takes the epf contributions of the employee and the employer and then calculates the interest on the contribution during that year and also on the. But this rate is revised every year. Employers are required to remit epf contributions based on this schedule. Kwsp epf contribution rates.

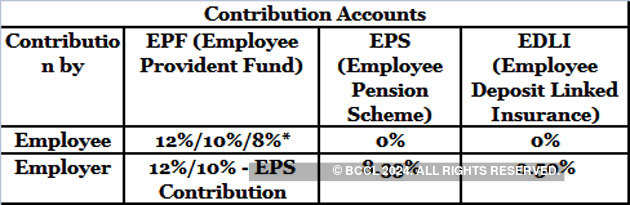

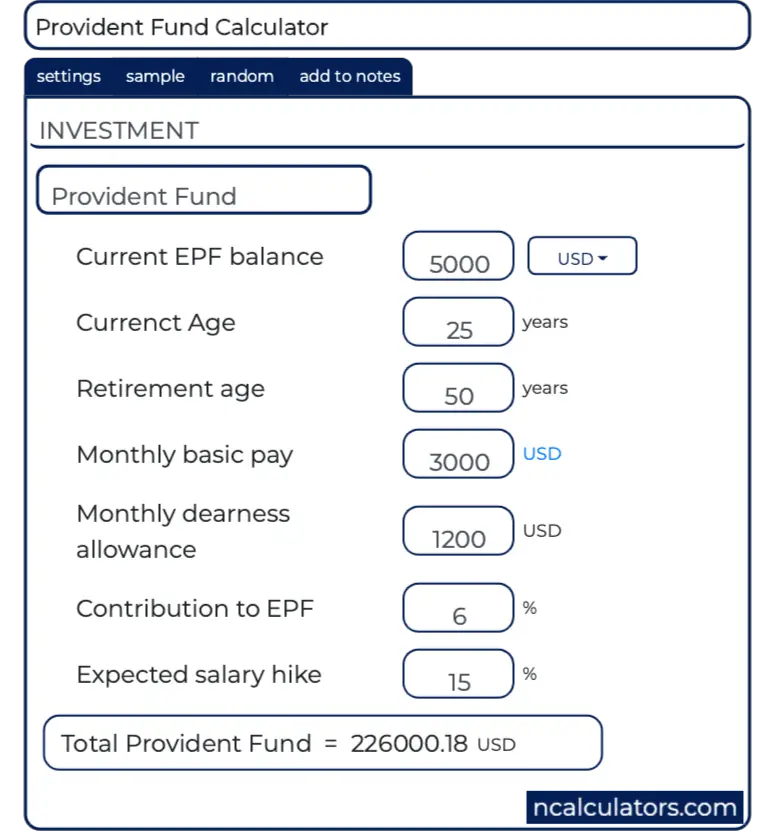

What it shows after entering the above information and submitting it the calculator will show how much you will save by the time you will retire. Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following. Epf nuances the foremost rule of epf is the contribution made by an employee will have to be matched by the employer. Know all about pf and epf benefits.

As of now the epf interest rate is 8 50 fy 2019 20. The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Your employee s contribution to epf and your employer s contribution. The employees provident fund calculator will help you to estimate the epf amount you will accumulate at the time of retirement.

Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule. Notification dated 9th april 1997 was issued enhancing provident fund contribution rate from 8 33 to 10. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

You can also check the past changes in historical epf interest rates. The money in the epf accounts are sovereign guaranteed. The epf receives and manages retirement savings for all its members encompassing mandatory contributions by employees of the private and non pensionable public sectors as well as voluntary contributions by those in the informal sector.