Epf Employer Contribution Rate 2019 Malaysia

Kuala lumpur jan 7.

Epf employer contribution rate 2019 malaysia. At the same time the employees share of minimum contribution rate has been reduced to 0 down from the previous 5 5 this was announced by the epf also known as kwsp kumpulan wang simpanan pekerja on 7. The new minimum statutory rates proposed in budget 2019 are effective this month for the. The minimum employers share of epf statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the employees share of contribution rate will be zero per cent. Every company is required to contribute epf for its employees made up from the employee s and employer s share and to remit the contribution sum to kwsp before the 15th day of the following month.

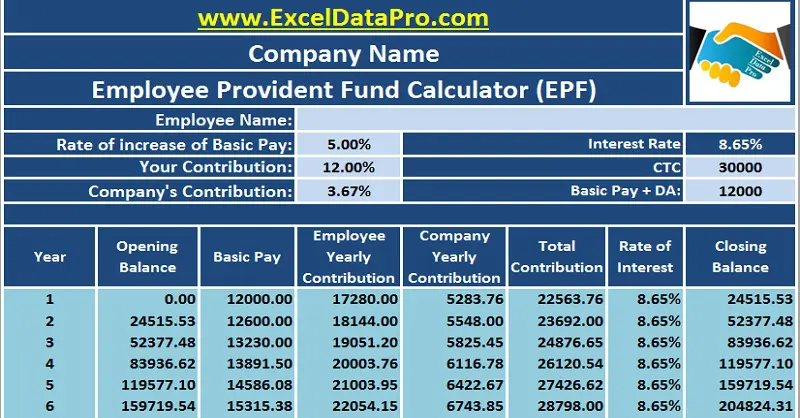

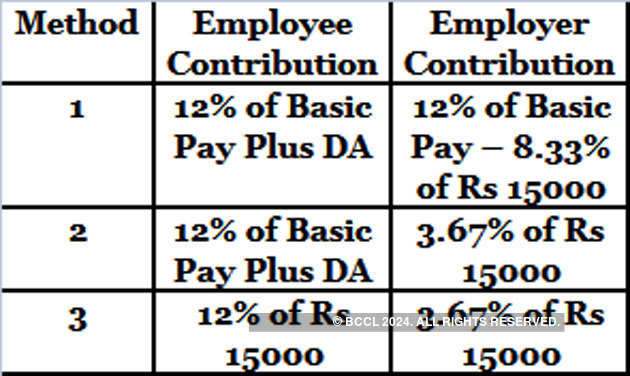

Effective from january 2018 the employees monthly statutory contribution rates will be reverted from. Currently employees contribute 11 of their salary to epf while employers must put in a minimum of 12 for salaries more than rm5 000 and 13 for salaries lower than that. The malaysian government has reduced the minimum employee contribution rate for the employees provident fund epf to 7 starting from april 1 in a bid to cushion the impact of the covid 19. Employee contribution epf 12 20000 2400 employer contribution eps 8 33 15000 1250 difference 2400 1250 1150 total employer pf 1250 1150 2400 note even if pf is calculated at higher amount for eps we will take 15000 limit only remaining amount wil go to difference.

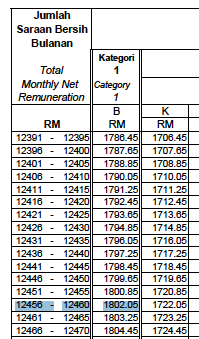

The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12. Employers are required to remit epf contributions based on this schedule. Meanwhile the employees share of contribution for this age group is set at zero the epf said in a statement today.

Failing to submit within the stipulated period will result in a late penalty charged by kwsp. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.