Gst Blocked Input Tax List Malaysia

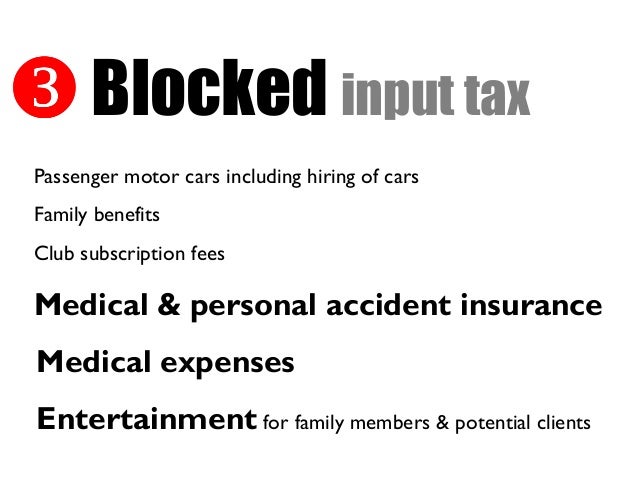

A the supply to or importation by him of a passenger motor car.

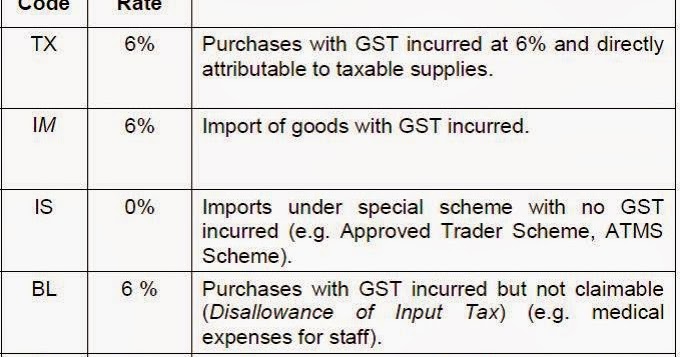

Gst blocked input tax list malaysia. While is general input tax is claimable under standard and zero rated supplies there are certain instances where input taxes are blocked ie. Supply or importation of passenger car including lease of. No input tax credit is available for the following. Under gst businesses are allowed to claim gst incurred on purchase of most goods and services.

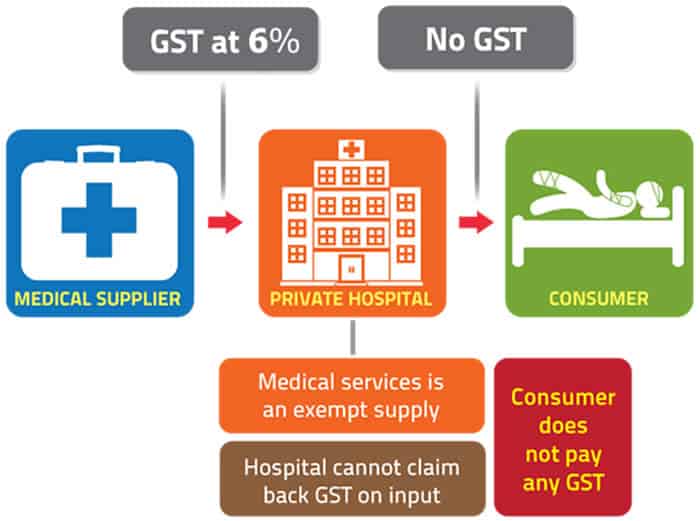

Which are those input tax which is blocked under the act. Gst malaysia blocked input tax some input tax incurred in furtherance to your business might not entitle to a credit under the malaysia goods and services act 2015. The implementation of gst system that has two rates of gst 6 and 0 and provides for the zero rating of exported goods international services basic food items and many books as a broad based tax gst is a consumption tax applied at each stage of the supply chain. Gst malaysia section 4 non allowable input tax.

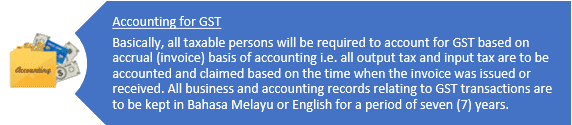

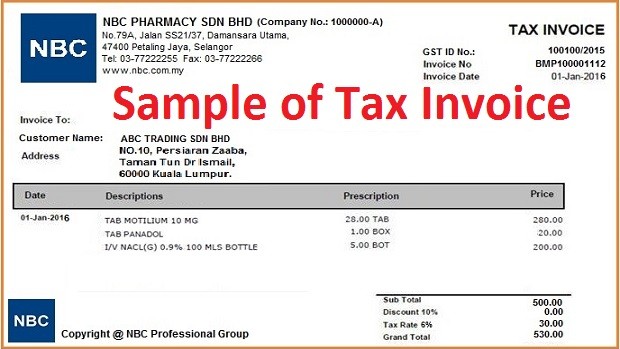

Malaysia gst blocked input tax there are goods and service or importation of goods may be denied to claim their credit s38 12 gst act. Melayu malay 简体中文 chinese simplified malaysia gst blocked input tax credit. You must make your claim during the accounting period that matches the date shown in the tax invoice or import permit. Malaysia replaced its sales and service tax regimes with the goods and services tax gst effective 1 april 2015.

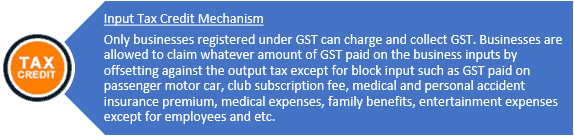

Under the gst category businesses are allowed to claim gst incurred on purchase of most. When purchasing from gst registered suppliers or importing goods into singapore you may have incurred gst input tax. Blocked input tax refers to input tax credit that you cannot claim. It is further guided based on regulation to prescribe on the items that are excluded.

You can claim input tax incurred when you satisfy all of the conditions for making such a claim. 1 the supply to or importation by him of a passenger motor car. Input tax is defined as the gst incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business. 14 blocked input tax credit itc under gst.

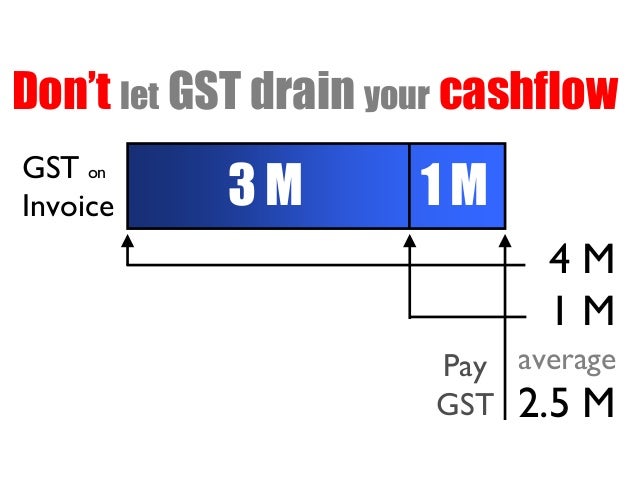

Those gst you can t claim is called blocked input tax credit. Gst paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly gst returns. There are some goods services tax gst you can t claim even though you have already paid for it when you made your purchases or expenses. Is based in malaysia and incurs gst on its operational expenses such as rental and utilities mnc is entitled to claim input tax that has been incurred on that supply.

11 incidental exempt financial supplies.