House Loan Interest Rate Malaysia 2020

Bank lending rate in malaysia averaged 6 28 percent from 1996 until 2020 reaching an all time high of 13 53 percent in may of 1998 and a record low of 3 64 percent in august of 2020.

House loan interest rate malaysia 2020. Know how much to repay every month throughout the tenure with a fixed rate home loan. As malaysia s central bank bank negara malaysia promotes monetary stability and financial stability conducive to the sustainable growth of the malaysian economy. Base lending rate blr 6 6 maximum loan amount 90. Enter down payment amount in malaysian ringgit.

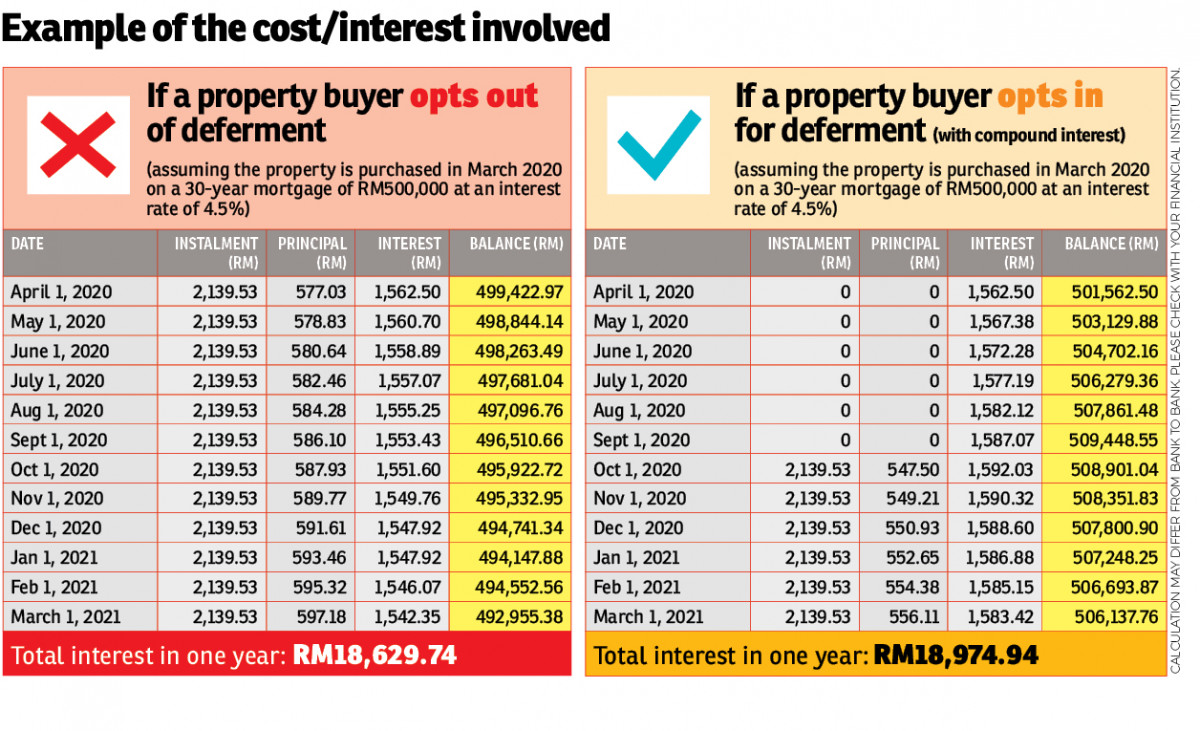

Bank lending rate in malaysia remained unchanged at 3 64 percent in september from 3 64 percent in august of 2020. With interest rates ranging from 1 250 to 2 000 you will have a monthly mortgage repayment sum of around 1 941 to 2 119 for a 25 year home loan of 500 000. 1300 88 5465 bnmtelelink 603 2698 8044 general line bnmtelelink bnm gov my. Jalan dato onn 50480 kuala lumpur malaysia.

Compare the cheapest home loans from over 18 banks in malaysia. Move into your dream house at zero cost with aia. Get interest rates from as low as 4 15 on your housing loan. Enter housing loan period in years.

Find the lowest interest rates in malaysia for the easiest personal loans. Do a quick check on your monthly repayment with loanstreet s home loan calculator and apply online right away. Do a quick calculation on your monthly repayments using our online housing loan calculator and save more. For private properties the following banks appear to be providing borrowers with the best fixed rate home loan packages.

For fixed rate mortgages singapore banks generally only to fix the rate only for the initial 1 to 5 years of the loan tenure after which interest reverts back to a floating rate and comes with a higher. If the opr reduces by 0 25 and banks decide to stick to their current profit margins then your loan s br will also reduce by 0 25. Enter property price in malaysian ringgit. Malaysia housing loan interest rates.

Generate principal interest and balance loan repayment table by year. Compare the cheapest housing loans from over 18 banks in malaysia here. Borrowing rm 450000 over 20 years. As of 2nd january 2015 base lending rate blr has been updated to base rate br to reflect the recent changes made by bank negara malaysia and subsequently by major local banks the interest rate on a br 0 45 loan would be 4 45.

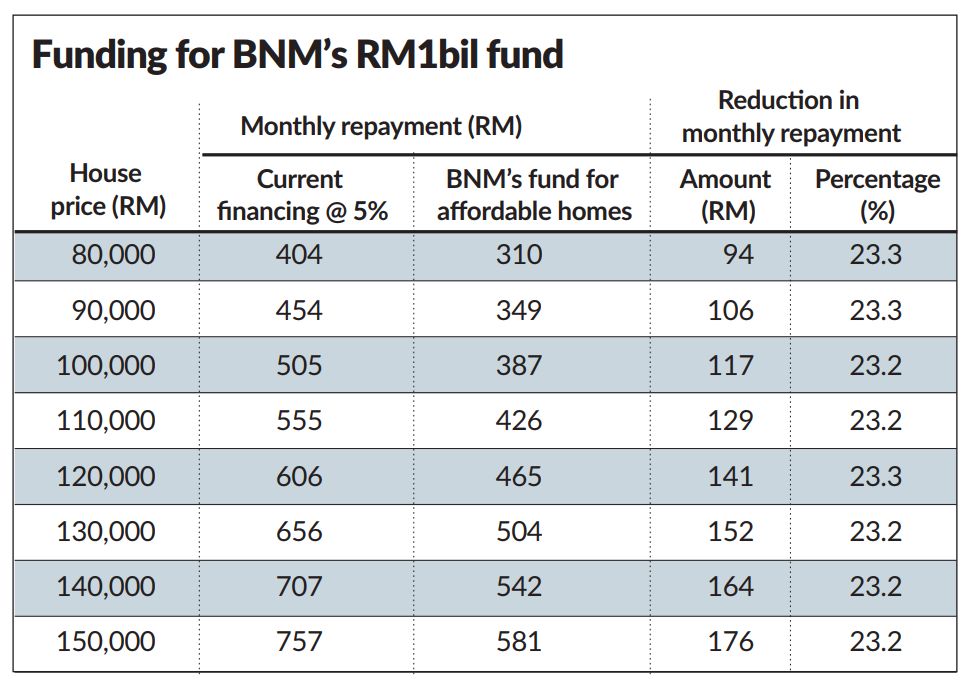

Get interest rate from as low as 4 15 on home refinancing with zero entry cost. Lower loan interest rates. Compare housing loans in malaysia 2020. Any changes in the opr will impact loans that use the base rate br or the base financing rate bfr to determine the interest rate by which it will lend to consumers.

For refinancing home loans in singapore or purchase of completed property homeowners would first need to choose between fixed rate home loan or variable rate floating rate home loan. Estimated interest rate 4 5 p a.