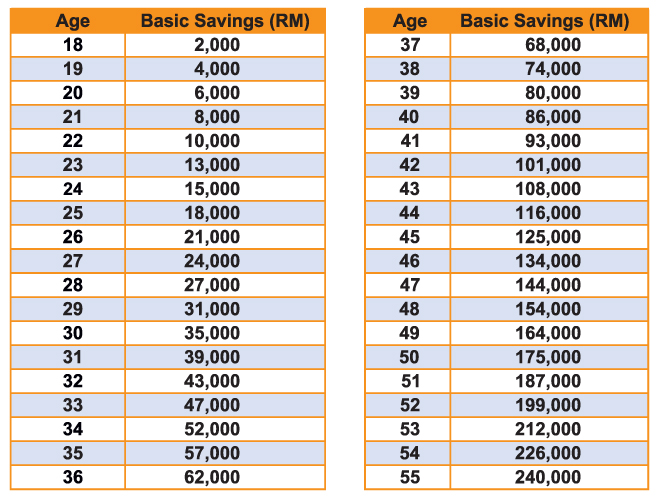

Kwsp Contribution Table 2019

Third schedule subsection 43 1 rate of monthly contribution part a the rate of monthly contribution specified in this part shall apply to a.

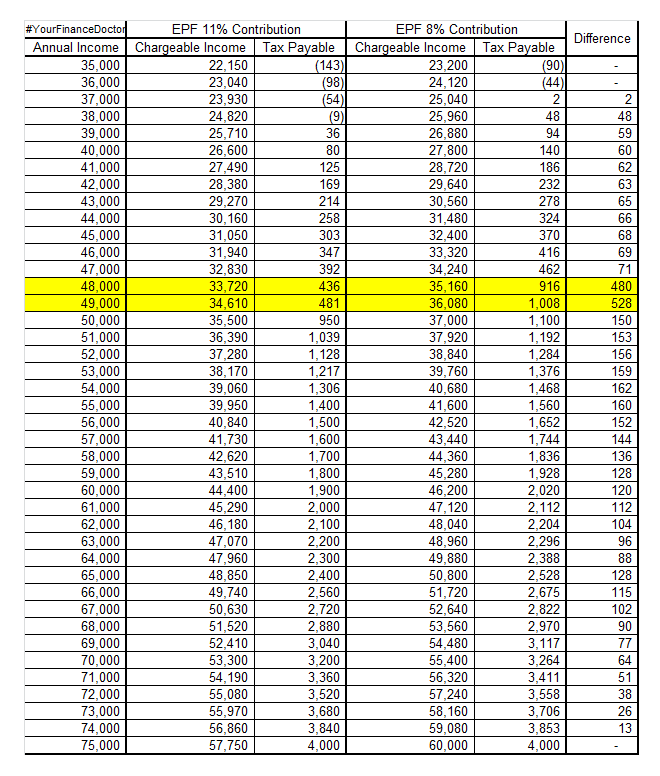

Kwsp contribution table 2019. The company will pay 1 75 while the staff workers will contribute 0 5 of their wages for the employment injury insurance scheme and the invalidity pension scheme. This calculator only takes into account the minimum contribution starting from 1 january 2019. Contribution to be paid on up to maximum wage ceiling of 15000 even if pf is paid on higher wages. For employees who receive wages salary of rm5 000 and below the portion of employee s contribution is 11 of their monthly salary while the employer contributes 13.

Actual contribution amount is subject to the following matters. The employees provident fund act 1991 is amended by substituting for the third schedule the following schedule. Please refer to the monthly contribution rate third schedule of epf act 1991 or kindly contact epf contact management centre. For employees who receive wages salary exceeding rm5 000 the employee s contribution of 11 remains while the employer s contribution is 12.

Each contribution is to be rounded to nearest rupee. Berikut dikongsikan cara pengiraan kadar caruman kwsp atau epf dan kadar caruman perkeso socso yang terkini bagi tahun 2019. Employers are required to remit epf contributions based on this schedule. Monthly contribution rate third schedule the latest contribution rate for employees and employers effective january 2019 salary wage can be referred in thethird schedule epf act 1991 employers are required to remit epf contributions based on this schedule.

A company is required to contribute socso for its staff workers according to the socso contribution table rates as determined by the act. Edli contribution to be paid even if member has crossed 58 years age and pension contribution is not payable. Both the rates of contribution are based on the total monthly wages paid to the. Employees provident fund malaysia epf is a federal statutory body under the purview of the ministry of finance employees provident fund epf will allow education withdrawals for professional certificate programmes under budget 2020 every company is required to contribute epf calculator for its staff workers and to remit the contribution sum to kwsp before the 15th day of the following.

The latest contribution rate for employees and employers effective january 2019 salary wage can be referred in the third schedule epf act 1991 click to download. Kwsp epf contribution rates. Online withdrawal application via i akaun has now been extended to age 50 years 55 years 60 years and withdrawal for savings more than rm 1 million. Example for each employee getting wages above 15000 amount will be 75 3.