Personal Income Tax Relief 2020 Malaysia

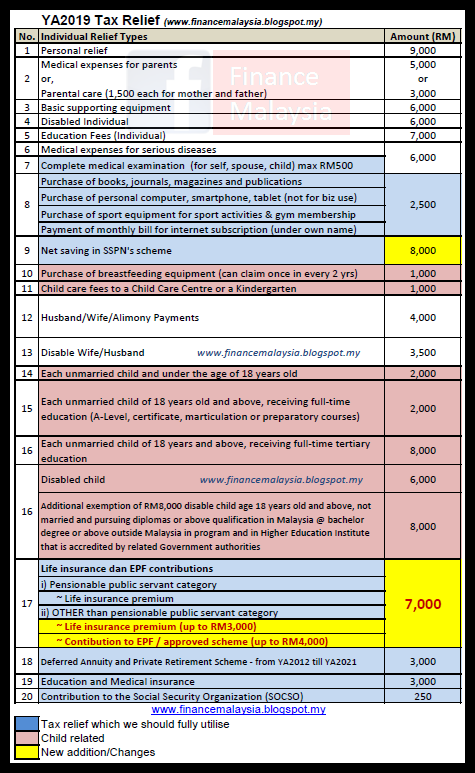

Below is the list of tax relief items for resident individual for the assessment year 2019.

Personal income tax relief 2020 malaysia. The gobear complete guide to lhdn income tax reliefs. The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. Personal tax relief malaysia 2020. Ringgitplus malaysia personal income tax guide 2020.

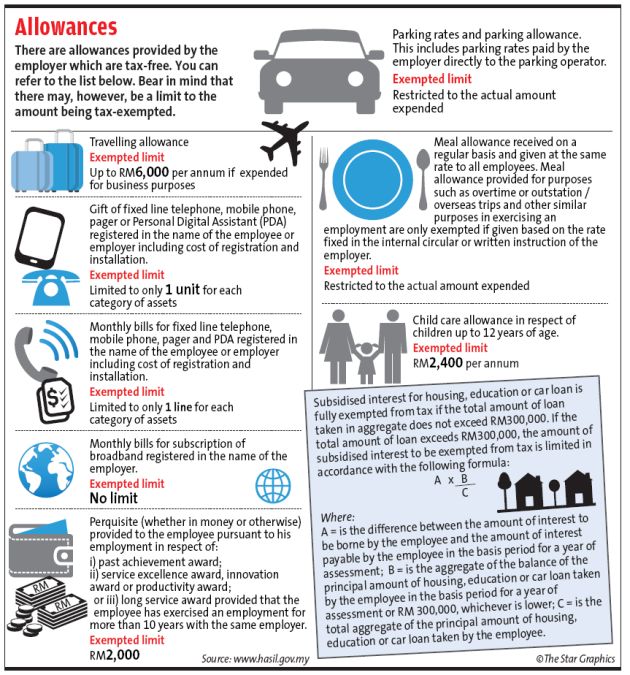

The relief amount you file will be deducted from your income thus reducing your taxable income make sure you keep all the receipts for the payments. Ringgitplus everything you should claim as income tax relief. Now that you know about all the income tax reliefs rebates and deductions that are available for malaysia personal income tax 2020 ya 2019 make sure to get your tax filing in order so you don t miss out on any claims. Don t miss out on maximising your income tax refund 2020.

Hence the tax relief is claimable by resident individuals for ya2020 and ya2021. For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. The prime minister announced that personal income tax relief in the amount of myr 1 000 on travel expenses incurred from 1 march 2020 to 31 august 2020 is to be extended to 31 december 2021.