Which Allowance Is Exempt From Epf

If you are wonder can a owner to contribute epf and his spouse then look no further on the contribution list.

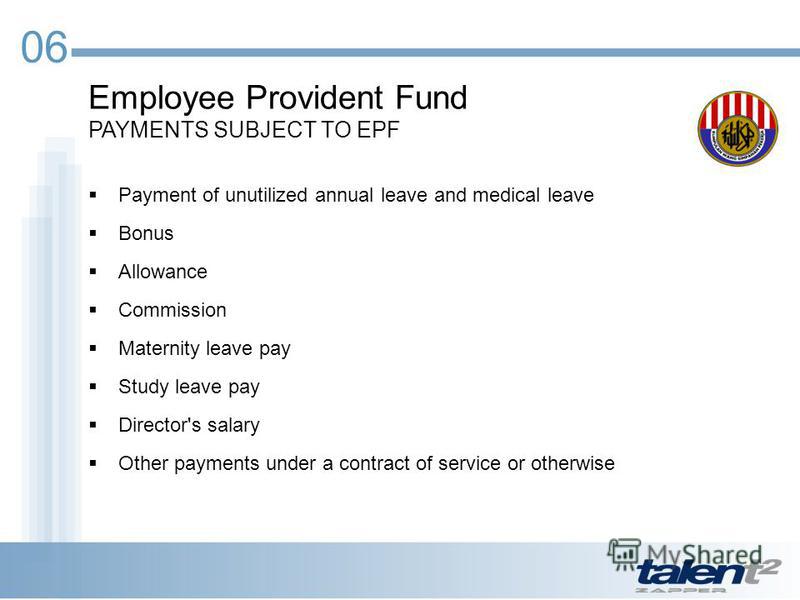

Which allowance is exempt from epf. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation retirement benefits. The payments below are not considered wages by the epf and are not subject to epf deduction. Any traveling allowance or the value of any travel concession. Epfo however circular does not clarify which these allowances are the flexibility exercised by employers and the provident fund authorities in the definition of basic wages has finally caught the attention of the employees provident fund organisation epfo.

Epf calculation need to calculate on basic all allowances hra or only on basic 12. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. It has sought to clarify the definition of basic wages. Epf members in the private and non pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers.

Allowances under sec 10 14 like travelling transfer allowance conveyance allowance helper allowance research allowance or uniform allowance any allowance granted to meet the expenditure incurred on a helper where such helper is engaged for the performance of the duties of an office or employment of profit. Statutory contribution for owner spouse an act to provide for the law relating to a scheme of savings for employees retirement and the management of the savings for the retirement purposes and for matters incidental thereto. Any other remuneration or payment as may be exempted by the minister. Allowance except travelling allowance is included in the definition of wages under the epf act.

Read more about not all allowances exempt from pf. Employees provident fund act 1991. Archive rules for statutory deductions exemptions on allowances perquisites archive. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope.

The flexibility exercised by employers and the provident fund authorities in the definition of basic wages has finally caught the attention of the employees provident fund organisation epfo. Payments exempted from epf contribution. Service charges tips etc overtime payments.