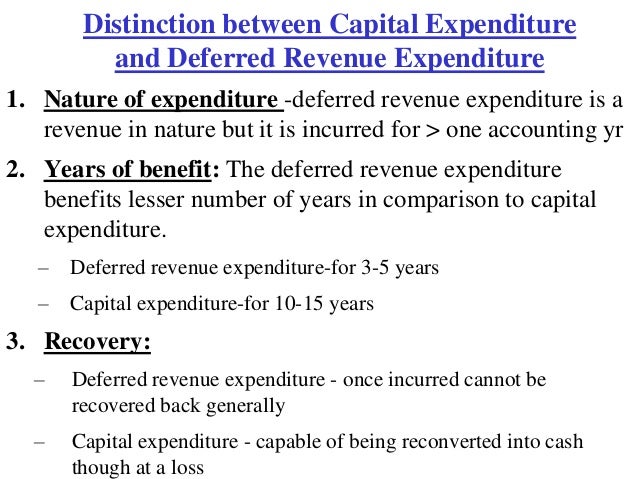

Difference Between Capital Expenditure And Deferred Revenue Expenditure

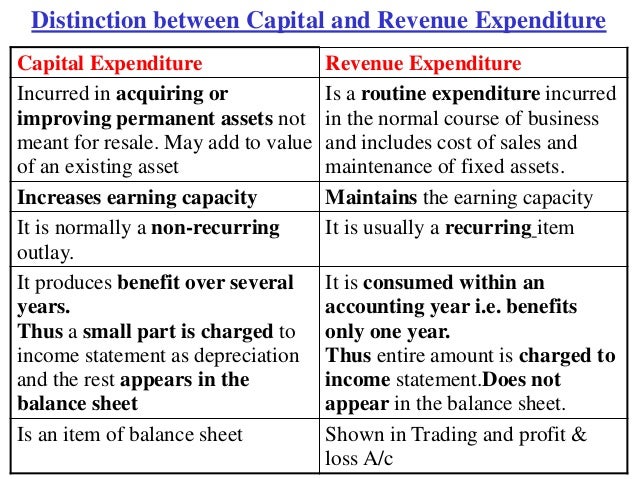

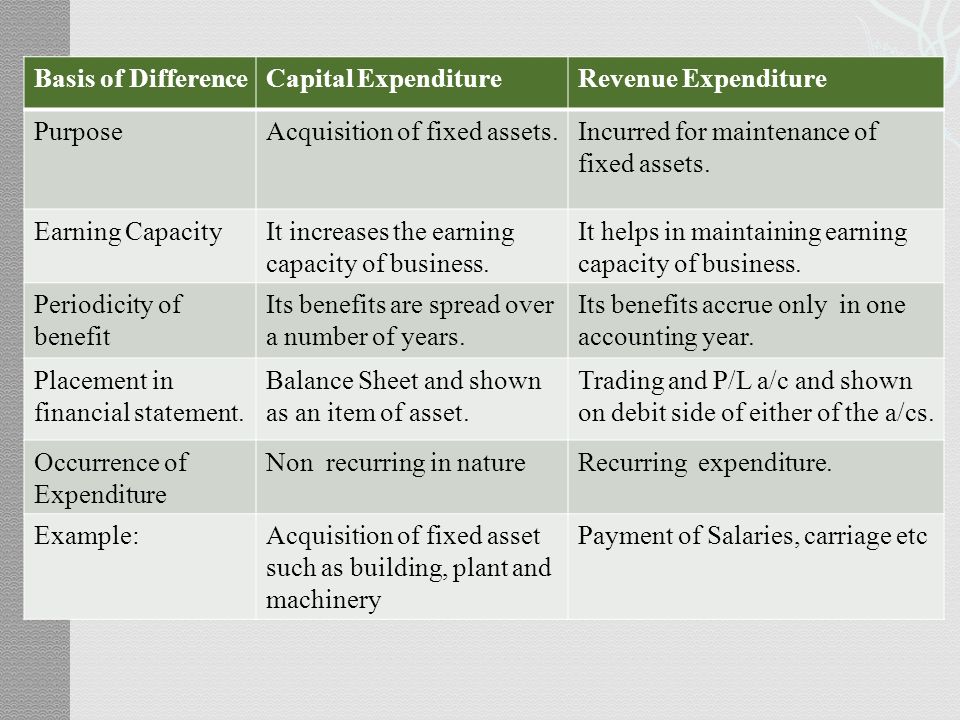

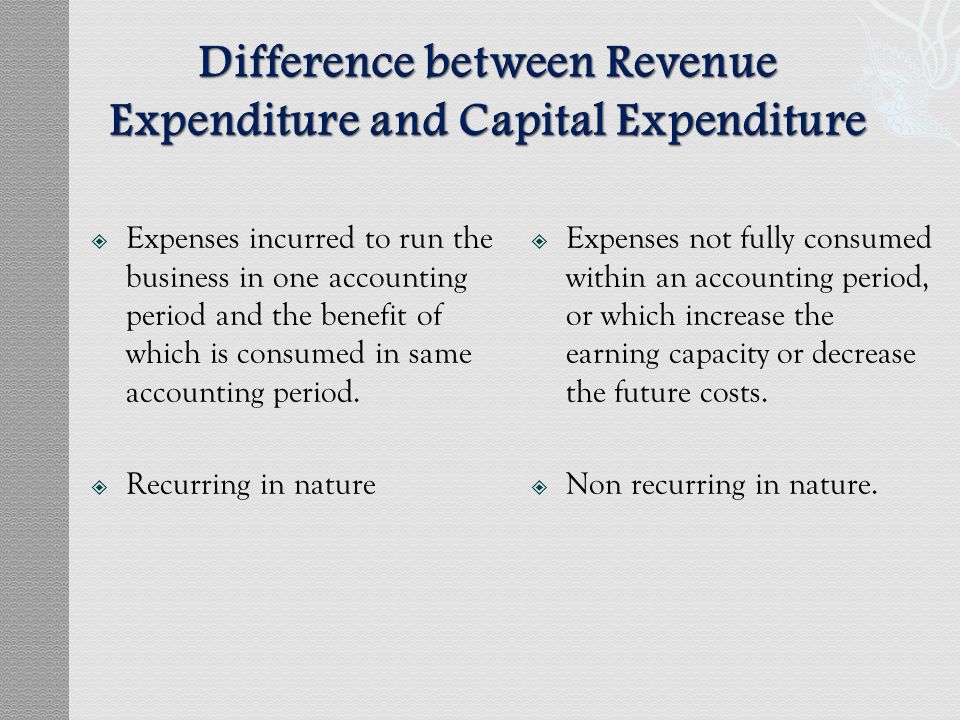

Differences between capital expenditure and revenue expenditure.

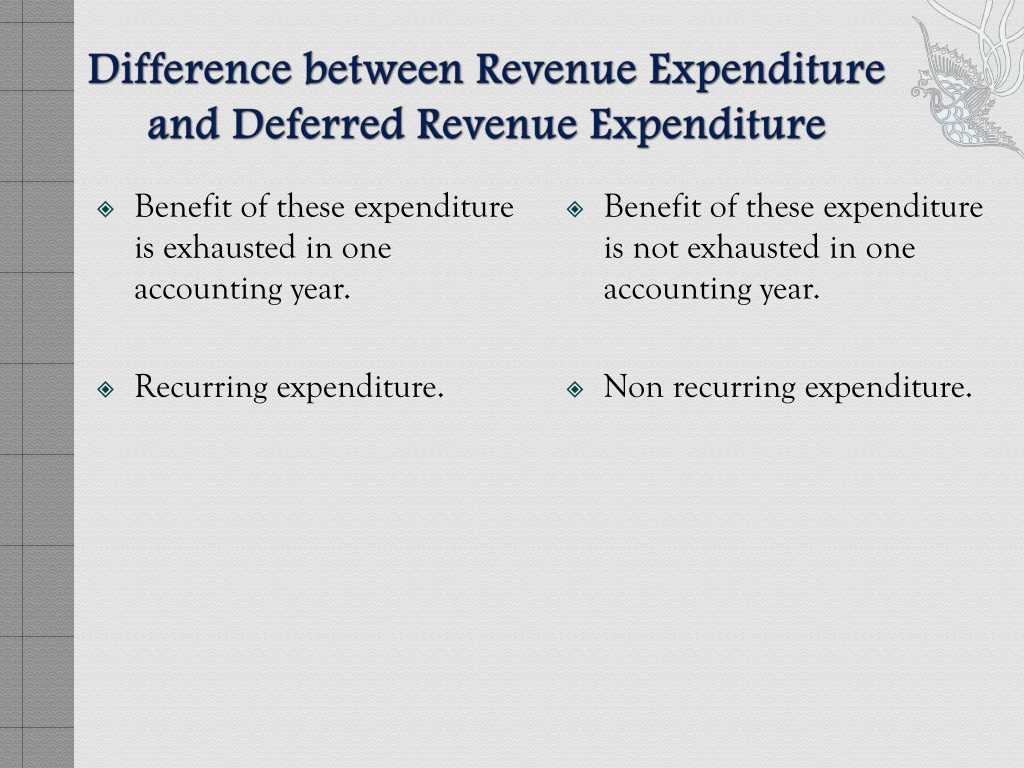

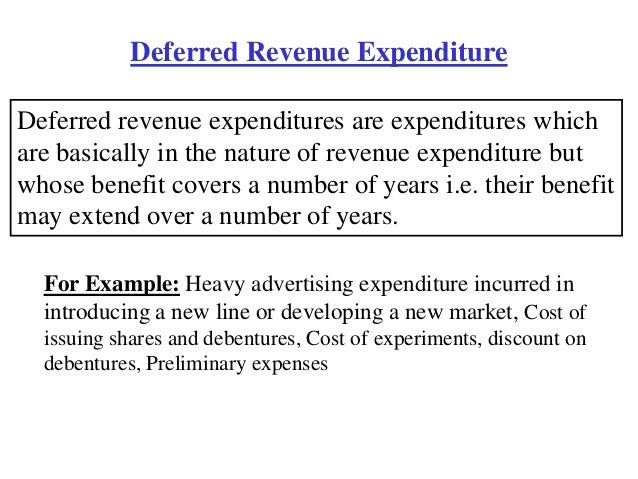

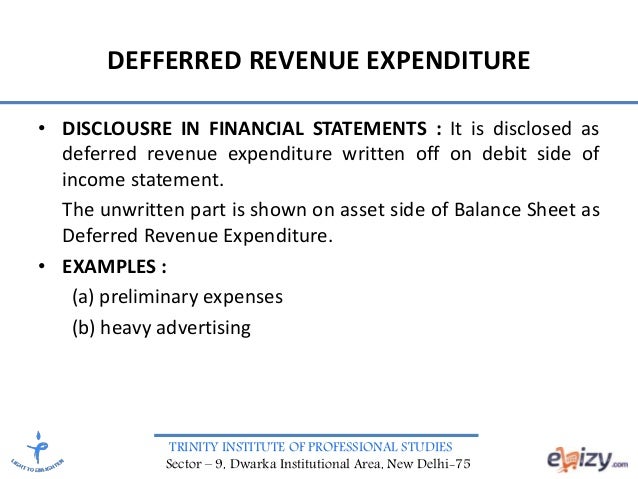

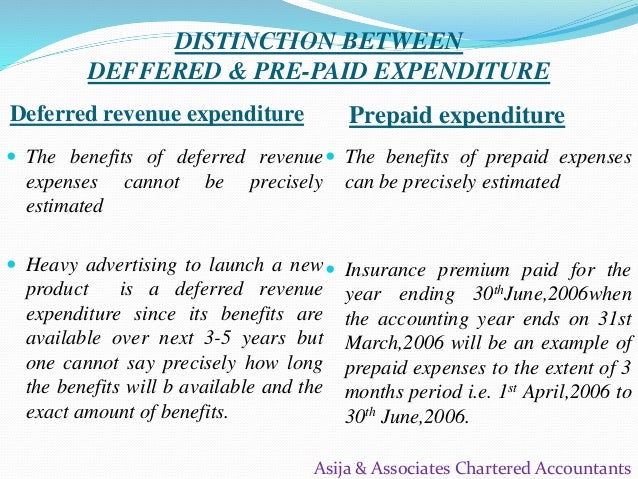

Difference between capital expenditure and deferred revenue expenditure. Its benefits accrue to the business for a future period say for 3 to 5 years. Its benefits accrue for a long time to the business say for 10 to 15 years. Capacity of business and revenue expenditure is aimed at maintaining that earning capacity. Capital expenditure generates future economic benefits but the revenue expenditure generates benefit for the current year only.

It can be converted into cash at any time as these are usually investments. The major difference between the two is that the capital expenditure is a one time investment of money. Key differences between capital and revenue expenditure.